But even in the more expensive centres there are pockets of affordability.

New research from OneRoof and its data partner Valocity has identified 35 suburbs where first-home buyers can still land a bargain.

The analysis has found for each of the country’s major metros the five suburbs with the lowest average property value. Surprisingly many of them are within easy commuting distance of their respective CBDs, showing buyers don’t necessarily need to head to far-flung fringes to get a foot on the property ladder.

According to Valocity data, first-home buyers took out 50% of all new mortgages from August to October this year, up from 41.7% a year earlier.

Valocity senior analyst Wayne Shum said first-home buyers tended to buy below average prices, although not necessarily at the very bottom end of the market. “There are some really affordable suburbs close to the CBDs, but what that story doesn’t tell us is they’re not the stock mix that a lot of [first-home buyers] look for,” he said. Typically it’s investors who buy the very cheapest homes and are prepared to take on do-ups.

The definition of what a “starter home” is had changed, said Shum. “While it used to be a basic home in the suburbs, it’s more likely to be a townhouse in a better suburb now.”

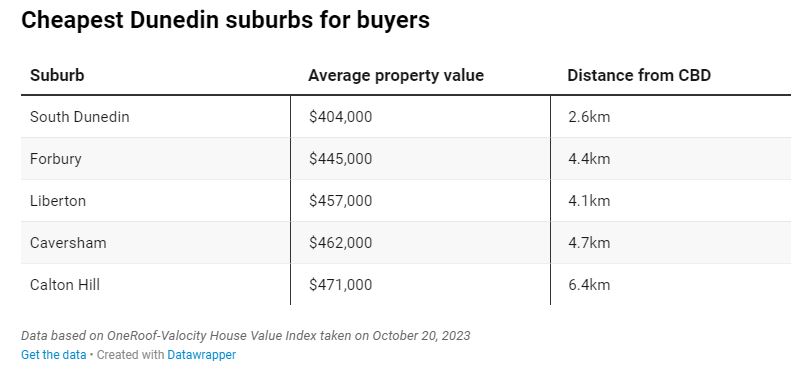

Dunedin is the country’s most affordable major metro, with an average property value of $652,000, but first-home buyers can get foothold in the city for much less.

In South Dunedin, properties typically trade for around $400,000. LJ Hooker agent Tania McCaul recently sold a colonial cottage on Wesley Street, in the suburb, to first-home buyers for $400,000.

The property last traded 60 years ago but the vendors had given it a top-to-toe renovation. “We sold it to a first-home buyer couple,” said McCaul. “That was really special.”

McCaul said Dunedin’s housing market had been boosted by construction of the city’s new hospital. “It’s all going pretty well in the $300,000-$400,000 price bracket,” she said.

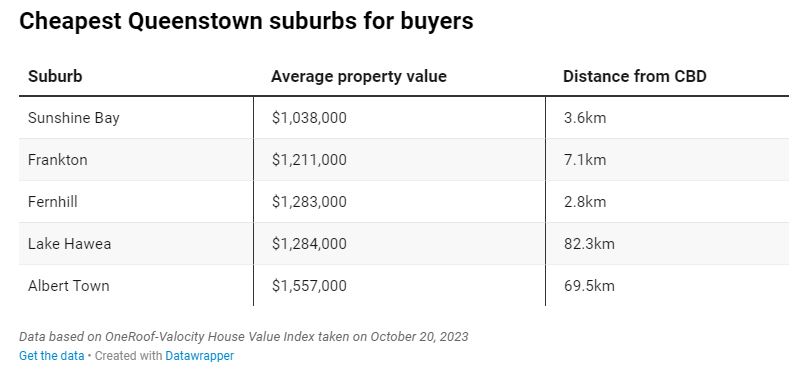

Queenstown is New Zealand’s most expensive spot for real estate. Its average property value is close to $2m – well out of reach for most first-home buyers – so it shouldn’t be a surprise that its cheapest suburb, Sunshine Bay, is expensive compared to prices in other cities.

Although listings are tight, especially at the affordable end of the market, One Agency agent Brian McMillan recently sold a four-bedroom plaster home on Williams Street, in Sunshine Bay, for $1m to an investor who planned to turn it into accommodation for workers.

He said buyers looking in that $1m price range would struggle to find anything modern and within a reasonable commuting distance of the city centre.

In fact, relatively affordable new-build developments tend to be closer to Wanaka than Queenstown, with Albert Town and Lake Hawea both on the far-flung edges of Queenstown-Lakes district.

Christchurch

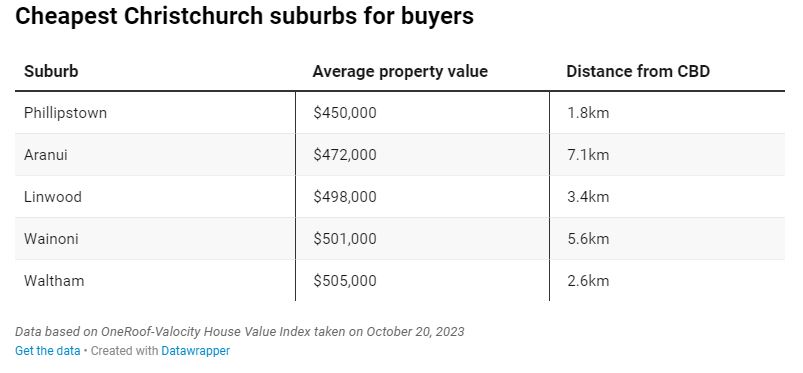

In Christchurch’s Phillipstown, Harcourts agent Keni Matangi sold a three-bedroom home on Bordesley Street for just under the suburb’s average property value of $450,000.

“It went to a first-home buyer,” said Matangi. “It had been on the market for an extended period of time. But it wasn’t until recently, once we saw the upswing in first-home buyers coming through, that we saw activity on that property.”

Matangi said even at that affordable end of the market, the vendors, like many currently, did have to adjust their price expectations.

Of the five suburbs highlighted in the OneRoof-Valocity data, Phillipstown is the closest to the city’s CBD but even the suburb that’s furthest from the centre, Aranui, is still an easy 15-minute drive in heavy traffic.

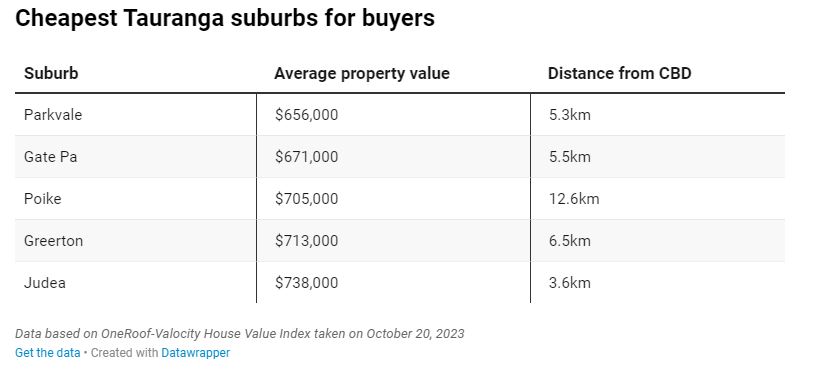

The most affordable suburb in Tauranga is Parkvale, where the average property value is $656,000, more than $400,000 below the city average and almost $1m below what buyers typically spend in Mount Maunganui.

Eves agent Gary Lee recently sold a three-bedroom, three-garage, home on Fraser Street, in Parkvale, for $667,000 to a couple of friends who pooled their funds to buy their first home.

“What was great about that property, was that it had double garaging and a hobby room downstairs in the basement, but also has a detached high stud single garage with workshops. That appealed to quite a wider part of the market. It was also elevated and beautifully facing north. In the afternoon the sun streamed in.”

A typical affordable home for the average of $656,000 in Parkvale, which is quite close to Tauranga CBD, would be a three-bedroom, one-bathroom freehold home that might need a little updating, said Lee. “It’s quite an older suburb, but there are a lot of younger families and younger couples starting out to get on the ladder.”

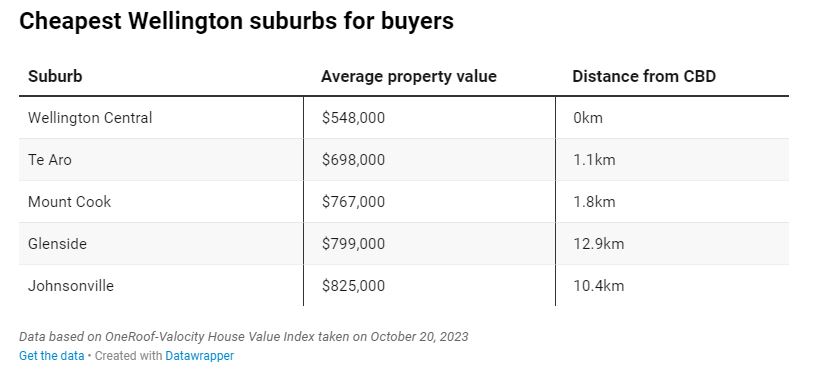

Wellington’s cheapest suburb, like Auckland’s, is apartment-heavy and bang in the centre of the city. Wellington Central has an average property value of $548,000, well below the city average of just over $1m.

Ray White Wellington City agent Debbie Bane said the big “but” with much of the affordable stock in the suburb was size: because most of the apartments are smaller than 50sqm banks aren’t keen on lending.

“You either have to have cash, or a bigger deposit,” she said.

Many of the suburb’s smaller apartments are bought by workers as a city pad, or by parents for their children attending university.

irst-home buyers do find options in the suburb, though. Bane said she sold a 60sqm one-bedroom apartment in the Montreaux building on The Terrace to first-home buyers for $548,000, describing the property as captivating and spacious.

Neighbouring Te Aro is Wellington’s next cheapest suburb, but first-home buyers looking for more than small apartments will have to look further afield. Mount Cook is the closest to the city centre offering buyers a traditional house. Its average property value is $767,000 and is still within walking distance for city commuters. The next cheapest, Glenside ($799,000) and Johnsonville ($825,000) are more than 10km out, however.

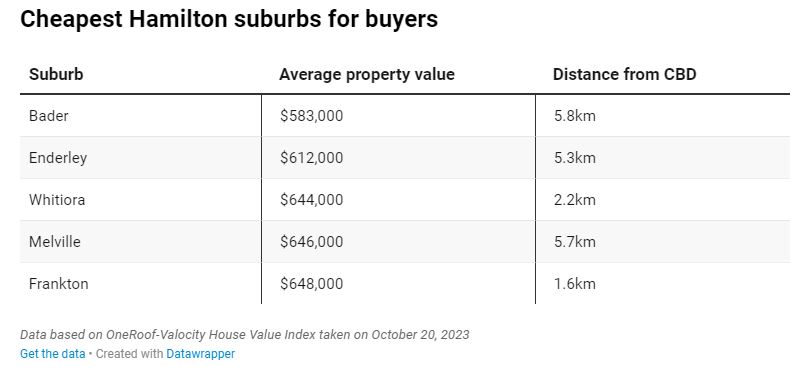

With an average property value of $583,000, Hamilton’s cheapest suburb is Bader. It’s also reasonably close to the CBD, although first-home buyers looking to cut down on the commute time could try Frankton, which is 4km closer but $60,000 more expensive.

Harcourts agent Craig Annandale told OneRoof that buyers looking in the sub-$600,000 price bracket could, if they were lucky, find a freehold three-bedroom home. However, most homes at that price point were cross-lease.

Annandale, who recently sold a three-bedroom weatherboard home on Bruce Avenue for $566,500, said the majority of the housing stock in Bader was built in the 1950s and appealed to owner-occupiers.

The agent said he had seen a pick-up in investor activity and increased demand for townhouses in the $600,000-plus bracket.

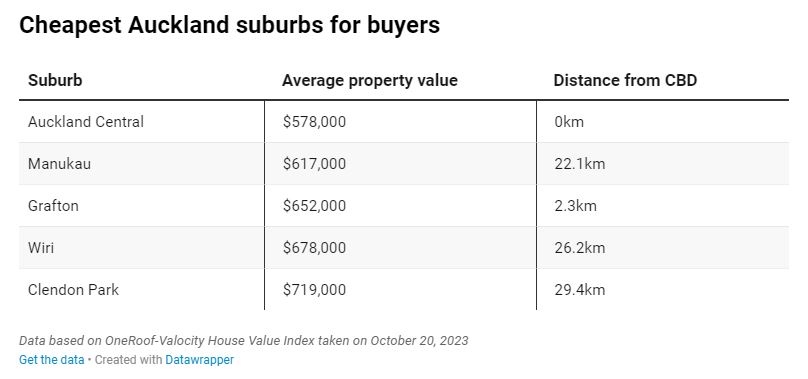

According to the latest OneRoof-Valocity figures, the average property value in Auckland is just over $1.3m, with just 39 suburbs in the city sporting an average property value of less than $1m. Most of those are on the fringes of the city, and involve a long commute for those working in the city centre, but the city’s cheapest suburb is also the one that’s closest to the CBD.

Auckland Central has an average property value of $576,000, but first-home buyers should note this is largely due to a large number of one-bedroom / studio apartments. These are largely favoured by cashed-up investors and international students and may not suit those looking for a start family home.

Nearby Grafton is also apartment-heavy, as is Manukau, in the city’s southern belt, but those looking for homes close to amenities and train lines, and aren’t necessarily bothered by size, could do worse than these three.

“If you’re a couple in your 30s looking for an affordable Auckland starter home, you’re probably looking at new townhouses. In the $650,000 to $700,000 price bracket there quite a few options in and around Mangere Bridge as well as in Sunnyvale, Henderson, Westgate, Silverdale and Millwater. It all depends on where you work.”

By Diana Clement