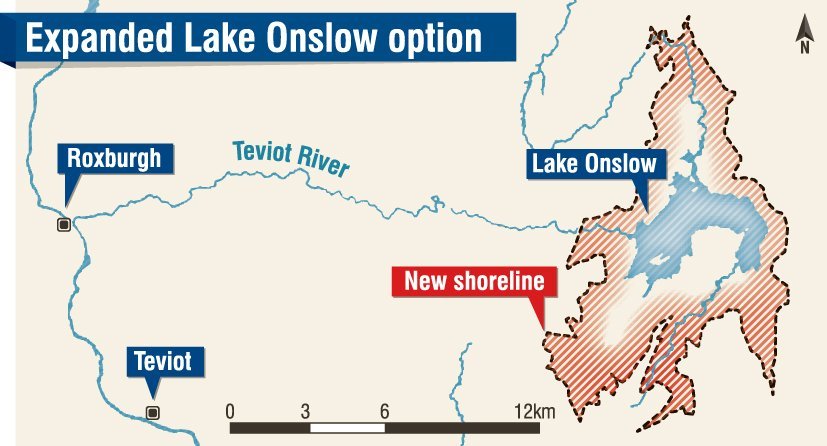

Nevertheless, creating a massive hydro lake above Roxburgh, in Central Otago, scored higher than the other option identified to move New Zealand to 100% renewable energy and solve the country’s "dry year" problem.

The Ministry of Business, Innovation and Employment initiated the NZ Battery Project in late 2020 to look for solutions for dry years when hydro-electricity lakes run low and coal is burned at Huntly Power Station to make up the electricity shortfall.

Now, the ministry has released the NZ Battery Project’s indicative business case, and Energy and Resources Minister Megan Woods presented the paper to Cabinet on the matter last month.

A pumped hydro scheme at Lake Onslow, and a "portfolio option" of alternative technologies (the combustion of biomass, a new geothermal plant used "flexibly", and hydrogen) were identified as the two preferred options.

They compared favourably to a "counterfactual" where renewable energy generation such as wind and solar was overbuilt so inter-seasonal storage was not required for the country’s dry years.

The business case revealed the preferred options were two options that remained from a long-list of 28 possible solutions.

These included proposals for increased energy efficiency; increasing existing hydro lakes; converting electricity to another form of energy; increasing existing electricity generation; using hydrogen to store energy; using biomass for electricity generation; and importing energy through a high-voltage direct current transmission system (HVDC link) across the Tasman Sea.

These options were cut to a shortlist based on their ability to address the dry year risk, support 100% renewable electricity generation by 2030, and whether the option was "broadly and reasonably" practical.

Lake Onslow scored poorly on the "value for money and affordability criteria", the business case said.

Further, there were known, significant negative cultural, social, landscape, recreational and environmental effects.

However, the alternative portfolio option scored worse on the value for money and affordability criteria.

And while it scored better than Lake Onslow with respect to its impact on cultural, social, landscape, recreational and environmental values, there was serious uncertainty around its impacts, because the places that might be affected by that option were as yet unknown.

In the value for money analysis, both of the preferred options returned only 40c to 50c of "public value" for every dollar spent, although this improved under certain scenarios.

Further, a return of less than $1 for every $1 spent was not unusual for infrastructure investments, which required significant capital costs up-front, while benefits "disproportionately accrue" over years.

Further, the business case said there were potentially money-making benefits that were not quantified in the initial business case.

Where possible, these would be quantified in a forthcoming detailed business case, it said.

If the Lake Onslow project went ahead, a construction workforce of up to 2500 people over seven years, with a peak of over 1000 workers at any one time, would be required.

New short-term accommodation and a form of construction camp would likely be required.

The massive lake would then take up to three years to fill, the business case said.