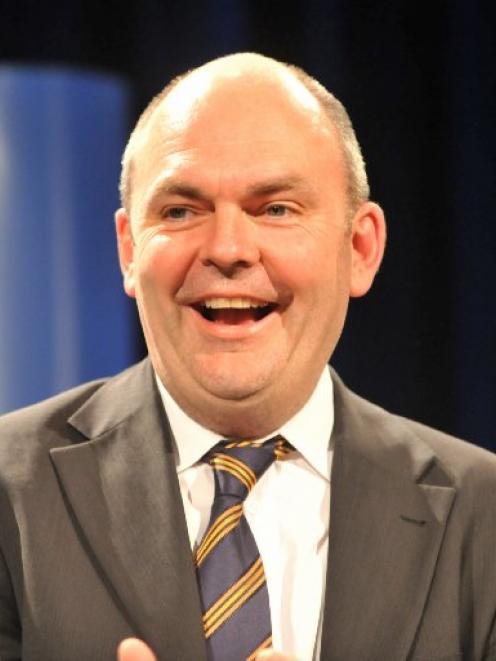

The Government remains committed to interest-free student loans but needs to take significant steps to reduce the spiralling costs and use of the scheme, Tertiary Education Minister Steven Joyce says.

That has been put down to more people choosing to undertake tertiary study and increases in living costs and fee payments.

Options being considered to reduce costs, with final details to be announced in the budget later this month, include a two-year wait for Australian and new residents before they can access loans and restrictions in the number of years a loan can be accessed for an undergraduate degree.

Putting extra pressures on students to perform to an adequate level - requiring them to pass at least half of their full time courses over two years to be able to keep borrowing from the scheme - was also an option being floated, along with increasing student loan administration fees.

Mr Joyce said taking into account student allowances and loans going to students to pay for fees and living costs, New Zealand spent 42 percent of the total tertiary budget on student support.

In comparison, the Australian spend was about 31 percent and the OECD average was 19 percent.

• Taxpayers are currently writing off about 47 cents in every dollar that is advanced on a student loan. We remain committed to interest-free student loans but we are looking at a number of things at the margin that will promote equity and fairness between students and taxpayers," Mr Joyce said.

• Figures show the number student loan recipients increased by 13 percent in comparison with the same quarter in 2009.

• The average amount borrowed by a student loan recipient for fees in the first quarter of 2010 was $4771 - 6 percent up on the first quarter of 2009.

• The average amount borrowed by a student loan recipient for living costs in the first quarter of 2010 was $762, up 5 percent on the average amount in the first quarter of 2009.