Proposed Government moves to rein in the student loan scheme "in a big way" could ultimately harm the Dunedin economy, Otago Polytechnic Students' Association official Mark Baxter warns.

Mr Baxter, who is the association's services and communications manager, said this week any adverse changes to the loan scheme could harm the city's tertiary education industry, which relied heavily on attracting out-of-town students.

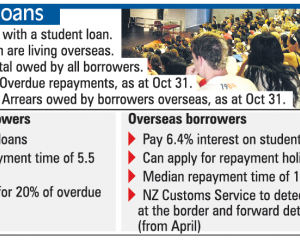

Prime Minister John Key said last week student loans would remain interest free, despite forecasts the national student loan bill would grow to more than $14 billion in the next three years.

Student debt sits at $12.9 billion, according to the New Zealand Union of Students' Associations (NZUSA).

Mr Key said keeping student loans interest free "may not be great economics but it's great politics", and he acknowledged the Government could be voted out if it reintroduced interest payments.

Government officials said last week that further detail about how the scheme would be "reined in" would not be made available until an eventual later announcement.

Earlier this week, NZUSA president Pete Hodkinson said continuing to waive interest payments was "a smart investment in a smarter New Zealand" and was not "bad economics".

New Zealand needed a skilled workforce in New Zealand, "not chasing higher incomes or avoiding their debts by living in Australia or the UK", he said.

Mr Hodkinson warned that in the United States, debt arising from interest-bearing student loans had reached $US1,000, 000,000,000 - one trillion dollars - and the US House of Representatives was considering a Bill to wipe student loans after 10 years of repayments.

Mr Baxter, who is also a life member of the Otago University Students Association, said much of the money spent by students in Dunedin had come from the student loan scheme. Any adverse changes to the scheme, including any significant restrictions in eligibility, could harm the city economy.

Some recent changes to the loan scheme - such as preventing over 55-year-olds from accessing the living cost component of student loans - were already restricting the ability of some older workers to retrain in order to change their careers and find employment, he said.

Advertisement