Chelsea Hamilton is standing in the home office that will become their baby's bedroom when she and James can afford to have a child.

She is 26: by definition, a middle-of-the pack millennial. Her mum is a tail-end baby-boomer. There is more that separates them than just the years.

At 26, Chelsea's mum, who had trained as a hairdresser, would soon be pregnant for the third time, with Chelsea's younger brother.

Chelsea's mum and her husband depended on his income to get by. Despite that, they were paying off the mortgage on their first home, their first significant debt. Paying down the loan and raising the kids was the focus.

Now, decades later, at that same age, Chelsea, and husband James (27), have also saved enough to put down a deposit on a home.

But getting there has required a couple of extra steps.

Previously a chef, James has retrained as an early childhood teacher, because the pay is better. They both work fulltime, Chelsea as a marketing consultant.

The young couple have chosen not to have children yet, because the dream of babies and a home was simply that.

The house was not their first big debt. Between them, they were saddled with a $70,000 student loan.

They have paid back tens of thousands of dollars, but still have tens to go.

"The concern for us, and what we talk about with our friends,'' Chelsea says, "is that ... we aren't able to achieve that checklist; education, job, house, marriage, children.

"We have friends who have had children and now can't afford a home. It seems like now, you can't have everything. Whereas, I know, even for my parents, you could buy the house with one income and small children.

"That's just not a reality now.''

MILLENNIALS. Once the mysterious, up-and-coming, business-not-as-usual generation looming on the horizon, they have now well and truly arrived.

In their late-teens to mid-30s, two billion-strong worldwide and 21% of the New Zealand population, they will make up 75% of the workforce in less than a decade.

The world has belonged to the baby-boomers. Gen-X were the heirs presumptive. Millennials are about to ascend the throne.

But what is the kingdom they are inheriting?

Boomers, born between the end of World War 2 and the mid-1960s, lived in a golden era. The reality for millennials is less shiny.

Home ownership is a touchstone for boomers' and millennials' dichotomous worlds.

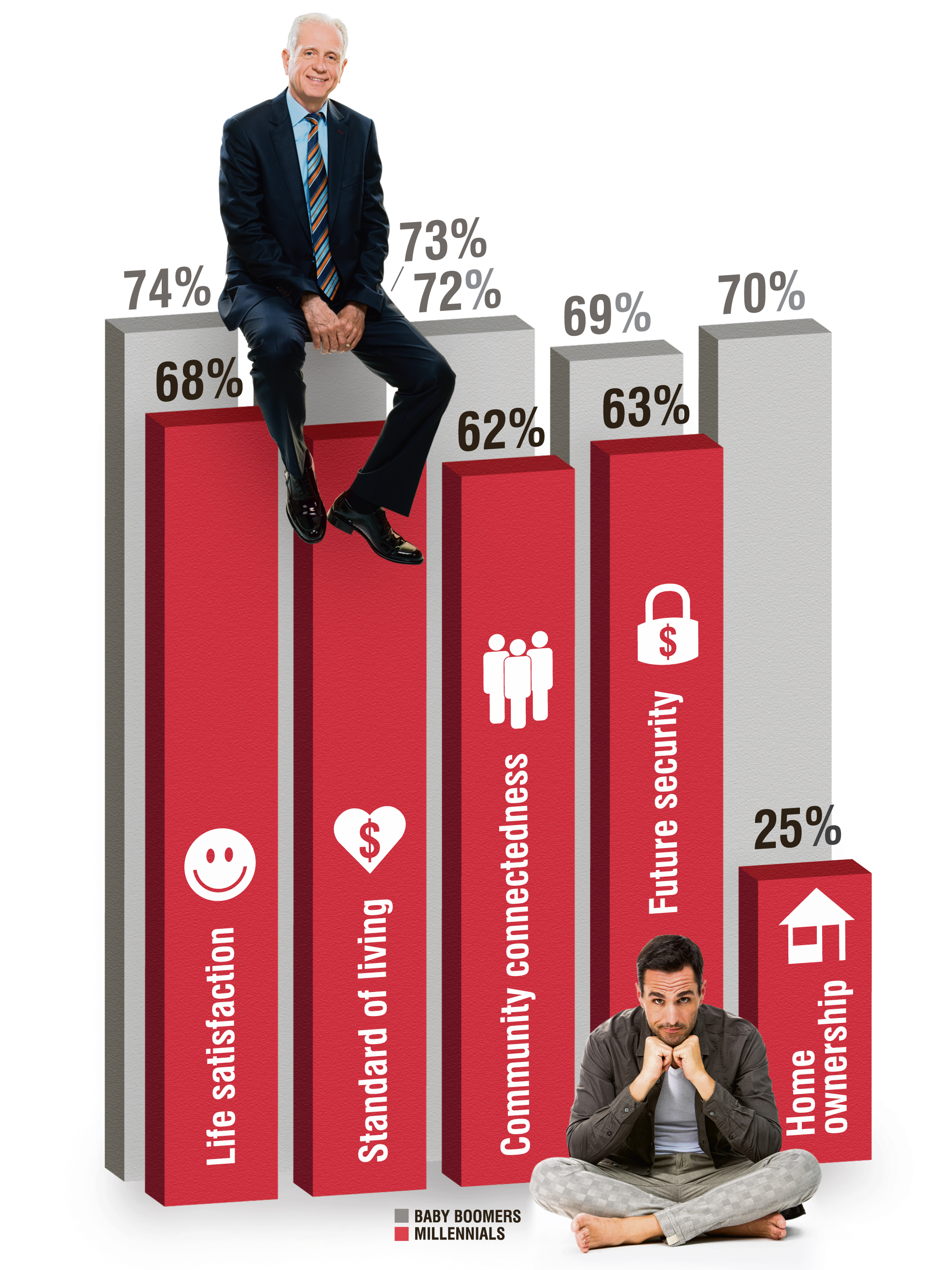

Almost 70% of today's boomers, who are either retired or in their final decade of work, own their own home. For millennials, the figure is a measly 25%.

That might not seem so bad. Millennials still have decades of earning in front of them.

But in 1981, when the last of the boomers were entering the workforce, 43% of 20- to 34-year-olds owned their own home.

A key reason for such a dramatic decline in the number of young people owning property is the cost of housing, which economist Peter Nunns says has risen an astonishing 350% since 1985.

As millennials attempt to climb the housing Everest, many have to haul two enormous weights; high debt and low wages.

For boomers, education, including university, cost them little. But somewhere in the late-1980s the "r'' fell out of free education. Today, 90% of tertiary students take out government loans to pay for course fees and living costs. More than 730,000 New Zealanders have a combined student loan debt of $15.3 billion.

Young people's efforts to rid themselves of debt are not helped by the undernourished job market. While the number of new jobs has been increasing, the percentage of those who cannot get enough work has been rising much more steeply.

Since 2008, the number of people employed has increased 19%. But during the same period, the number of people unemployed has increased 49% and the number of those underemployed - people employed for fewer than 30 hours a week who would like to be working more hours - has increased 61%.

It is a global problem. In the United Kingdom, a private thinktank, the Resolution Foundation, recently released a two year investigation into Millennial Britain. It has found that generational progress is stalling; that on housing and wages young people are comparatively worse off than the previous generation, and that Britain faces the huge task of renewing the social contract between generations.

IT can be argued that boomers have exploited the world's resources to fuel their own generation's economic growth. Most have enjoyed plentiful and secure employment, free health and education.

Many have paid off their homes, are enjoying regular travel and are either lapping up or looking forward to a super-annuated retirement supplemented by their own savings.

Millennials, in contrast, get high debt, a low-wage economy, unaffordable housing, a pared-back welfare state and a precarious future in a polluted world.

This is the first generation in the modern era to face a reduced standard of living compared with the previous generation.

"There is something fundamentally wrong when key workers - the teachers, the nurses and police - can't buy a house,'' says Leonie Freeman, an Auckland entrepreneur and housing advocate.

"Do we believe that we inherit our land, our city, our country from our parents? Or, do we believe we are stewards for our children?''

The takers and the givers, the winners and the losers, in this intergenerational contest seem to be clear in Prof Jarrod Haar's data.

Prof Haar, of Auckland University of Technology, loves to crunch numbers.

He conducted a nationwide "wellbeing at work'' survey. The tale it tells about how boomers and millennials feel about their lives is, well, telling.

A representative sample of Kiwis were asked to rate their lives on a raft of wellbeing issues, such as life satisfaction, standard of living, life achievement, community connectedness and future security.

On each of those measures, millennials lagged 6% to 10% behind boomers.

It's not so much about the degree of separation, although that is significant, but the fact that millennials' wellbeing is lower than boomers' on every measure, Prof Haar says.

It looks bleak.

But, talk to millennials and, yes, they are frustrated about drawing the short straw and what that is costing them, but a proportion - what sized grouping is unclear - are neither despondent nor resentful.

"Don't get me wrong. It is frustrating for all of us, it's really frustrating,'' Chelsea says.

"But we've just pulled up our bottom lips and got on with it, because complaining isn't going to change it.''

Dunedin business consultant Deon Aldridge, who has written a book on millennials in the workplace, Flushed: Getting your young employees to care about the customer toilets ... and love their work, says being cause-driven is one of the defining positive characteristics of this generation.

Chelsea has this in spades. She says it is one of the strategies her generation uses to stay positive despite the limitations they face.

At 23, she was helping market luxury cars worth much more than the home deposit she was struggling to scrape together. So, a chunk of her job satisfaction came from organising charity toy drives.

"That was where I got my motivating sense of purpose; the feeling that I was doing something good.

"It's good to have something to focus on. Getting a house might be a million miles away, but helping fundraise or volunteering or advocating for rights is something I could do to get some immediate satisfaction.''

At 23, and the youngest MP in Parliament, the Green Party's Chloe Swarbrick accepts she is viewed as the voice of Aotearoa youth.

"Uncertainty characterises the future for many millennials,'' Auckland-based Swarbrick says.

"Whether it's climate change or social mobility ... and there's just such precariousness these days around housing and work.''

Despite that, Swarbrick says most millennials, at least those she knows, are still very keen to collaborate to solve their own, and the world's, woes.

"I'm really averse to this trope of intergenerational war ... Sure, there is some frustration that certain millennials have around the fact that they feel they don't have the same opportunities as their predecessors, particularly for social mobility.

"I think the real question is, we are faced with this reality that by far the majority of wealth and power is held in the hands of boomers, so how are they going to use it? That's what matters.''

IT is a point that society and economics researcher Max Rashbrooke has been making this month.

Wellington-based Rashbrooke has shown that those with wealth have been getting a bigger share of the profit from business.

He says the average worker would earn $11,500 more a year if wages had kept pace with economic growth since the early 1980s.

But instead of going to workers, an increasing share of company profits have been going to shareholders, banks and other investors.

And, of course, many of those getting more are boomers and those getting less are millennials.

Rashbrooke's conclusion is that "working poverty could be sharply reduced simply by ensuring that ordinary staff - the people who do the bulk of the work in a given company - get a larger share of that pie''.

Wilbur Townsend makes the same point in a different way.

Townsend is a young, award-winning New Zealand academic who is on a predoctoral scholarship at the Stanford Institute for Economic Policy Research, in the United States. He says that, compared with 1975 when boomers were first entering the workforce, $32 billion a year is going to those who have wealth rather than those who pull a pay packet.

Morgan Godfery concurs.

He is a millennial and the editor of a book detailing millennial thoughts on the future, The Interregnum: Rethinking New Zealand.

Like Swarbrick, Wellington-based Godfery does not like to view the problem as an intergenerational war. And like Rashbrooke and Townsend, he sees it as "a fight between the people who own stuff and the people who work for a living''.

Some boomers own dozens of homes, locking younger people out of affordable housing. But there are some millennials who do the same thing, he says.

Boomers helped the country declare itself nuclear free and helped bring down apartheid, he says.

"Boomers aren't evil ... and millennials aren't wholly pure either,'' Godfery says.

"At its heart, this is an old-fashioned debate about wealth distribution. Who owns what and how much? But the answer isn't to deprive boomers. The answer is to empower and enrich everyone; boomers, millennials and Generation Z too.''

How do we restore fairness and hope? Does the welfare state need a radical overhaul? Is it a political or economic earthquake that is required? Will the solution be top-down or bottom-up?

Prime Minister Jacinda Ardern says she wants to put fairness at the heart of all Government decisions.

To that end, the Government is also introducing a Living Standards Framework.

"From next year, we'll be the first country in the world to track our progress as a country, not just by increases to GDP, but also by how well we're doing on the environment, and for our people.''

The Welfare Expert Advisory Group has also been established, to recommend what changes might be needed "to ensure our welfare system provides the support and dignity that our people deserve''.

It won't be a quick fix, however.

"Our work ... is all done with a view of the next 30 years, not just the next three,'' she says.

Townsend is casting a revolutionary eye at the welfare system.

Our welfare state has two jobs, he says. The first is to be a safety net. If you get sick or get sacked, the state will look after you until you've recovered.

The second job, he says, is ensuring we have the capacity to live a good life, regardless of how much we're paid or how many houses we own.

"Now that most of New Zealand's income is going to the owners of wealth, that second job is much more important,'' he says.

"The best way the welfare state can do that job is by supplementing the incomes of working-age people, just like superannuation currently supplements the incomes of older people.''

Freeman, the Auckland businesswoman, certainly isn't expecting the needed change to come from politicians.

"We have a culture of thinking government or council have to solve these things,'' she says.

"But short-term, three-year election cycle plans don't solve these big issues. That's the disruption, the change, that we need to think about.''

Freeman champions the "collective impact'' approach: bringing together everyone who has a part to play, under a non-governmental oversight body that co-ordinates and drives efforts towards agreed goals.

No matter how we get there, Swarbrick says millennials' participation should be welcomed.

"There is an appetite [among millennials], absolutely, to work intergenerationally to solve these problems,'' she says.

She shares people's concerns about the mental health of millennials. Constantly moving house and job, as many millennials have to do, robs them of community and a sense of belonging. She believes this lies behind the pandemic of youth mental health issues.

But at the same time, the variety of experience millennial life affords can be an asset, Swarbrick says.

"The biggest criticism I faced was that I lacked life experience. But what is life experience? A lot of older people have spent the past 40 years doing exactly the same thing day in and day out, not exposing themselves to new and novel ideas or issues and therefore not having to come up with new and creative solutions.

"The life experience that young people have is one that I hope makes them more collaborative, open-minded and able to think critically, because they are not so stuck in their ways.''

Swarbrick thinks structural change - laws affecting taxation, incentives, subsidies and cost of living - are needed to give a fairer distribution of wealth. She also believes cultural change - values, awareness and behaviour - needs to be driven by broad community activism.

"I'm loathe to perpetuate the narrative that politicians wield all the power.

"Where you don't have power and wealth, you have power in numbers.''

Chelsea's gaze sweeps around the room. She hopes that one day she will stand here talking quietly with her mother while her baby sleeps.

"Every generation has made mistakes. But we've inherited a lot of mistakes, too. We didn't pick how the economy played out. We inherited that and we inherited the state of the environment.

"We also need to see the wood for the trees and realise some things are possible, and not become dispirited by it all.

"Every generation has had its struggles. I don't begrudge boomers for the advantages they've had. What I find frustrating is ... they don't always see that there are young people who don't feel entitled and who are working hard to get somewhere better, to make things better.

"Rather than criticise each other, every generation needs to lift the other generations up.''

Comments

My heart goes out to the younger generation. I have a daughter living in Sydney with a good job- by herself she will be 35 years old before getting enough for a deposit for a 2 bedroom flat, 30 mins from the CBD. And 60-65 years old before she pays it fully off. That is not what life was supposed to be about. In NZ it is better, but not by much.

With a various roles in finance, banking and accounting, my personal opinion is that the availability of credit (and the cost of credit-interest rates) are singularly the biggest driver of house prices. Immigration just adds more pressure.

2 solutions:

It may seem an oxymoron- but if the Reserve Bank and all the world's central banks let the market determine interest rates- then they would rise- and pop or deflate the grotesque asset bubbles in real estate. That would let the younger generation get their first house, however, existing owners would loose. The alternative is to wait 10-15 years for the baby boomers to die off (morbid but true-its demographics) in increasing numbers. Only then would the supply constraints be more fully addressed. This assumes the government does not increase GDP by increasing immigration.

Another way is to reduce taxation, for the millennial cohort, and means test Superannuation.