Mayor Radich, Councillors and the Community,

We are a group of concerned citizens who oppose the sale of Aurora Energy. Dunedin City Holdings Limited (DCHL) have proposed to sell Aurora Energy and use the net proceeds to create an investment fund. The genesis of this proposal is unclear as neither the Mayor or any of the current councillors campaigned at the last election on a platform that included the sale of Aurora.

Mr Richard McKnight was a partner at accounting firm PwC in Dunedin for over 30 years and is passionate about the future of Dunedin. Mr McKnight has analysed Aurora’s position, including reference to the financial projections presented by advisors to DCHL, Mafic Partners in a recent council workshop. His advice is summarised as follows:

- Aurora is forecasting a net profit after tax of $31M in 2026 rising to $52M by 2034.

- Aurora is forecasting 14,000 new connections between 2025 and 2034, principally arising from growth in Queenstown and Central Otago. It is this growth that requires investment, but which is also driving higher profits and returns for Aurora’s shareholders in the medium term.

- It is a very real concern that the pitch by DCHL to sell Aurora is based on short term forecasting rather than the long-term outlook for the company. The significant upward trend from 2027 to 2034 suggests that the outlook for Aurora beyond 2034 is extremely positive. Advisors acting for potential buyers of Aurora Energy will be seeing exactly the same picture.

- Unlike Aurora, most businesses do not get a guaranteed rate of return on their assets and capital expenditure. Aurora has recently invested heavily in a significant catch up of capital expenditure. The return from this cost will be recovered by Aurora from 2026 onwards, for the benefit of its shareholders at that time, whoever they may be.

- The debt that Aurora holds is good debt because it can be leveraged to increase the return to the shareholders. The interest on this debt is paid from the operating profit of Aurora and having this debt gives the shareholders access to the significant capital gains produced by the company. This return will almost certainly outperform any income from an investment fund in the medium and long term. DCHL’s own Statement of Intent for Aurora shows a significant dividend from 2027 onward.

- Monopolies or similar businesses are nearly impossible to create or find, so why sell one that Dunedin City already owns? For any investor, selling your best asset should always be your absolute last resort.

- Courage is required, not weakness.

Aurora has just announced a net profit before tax of $35.9M for FY2024, compared to a budget of $22.1M and a result for the same period last year of $16.1M. This demonstrates the rapidly improving financial performance of Aurora which is well beyond expectations.

Over the same period the Waipori Fund earned 4.4% but failed to keep pace with inflation or pay a dividend.

We urge you to consider the compelling financial and social reasons to retain Aurora which have been advanced by all parts of the wider community. The public consultation undertaken by the DCC and a recent poll in the ODT show that close to 90% of the Dunedin community want to retain Aurora. Will you side with the bureaucrats who want to sell Aurora for short term reasons, or the 90% of Dunedin constituents who want to keep it?

While the sale of Aurora was not an election issue in 2022, the outcome of this decision will most certainly be one in 2025.

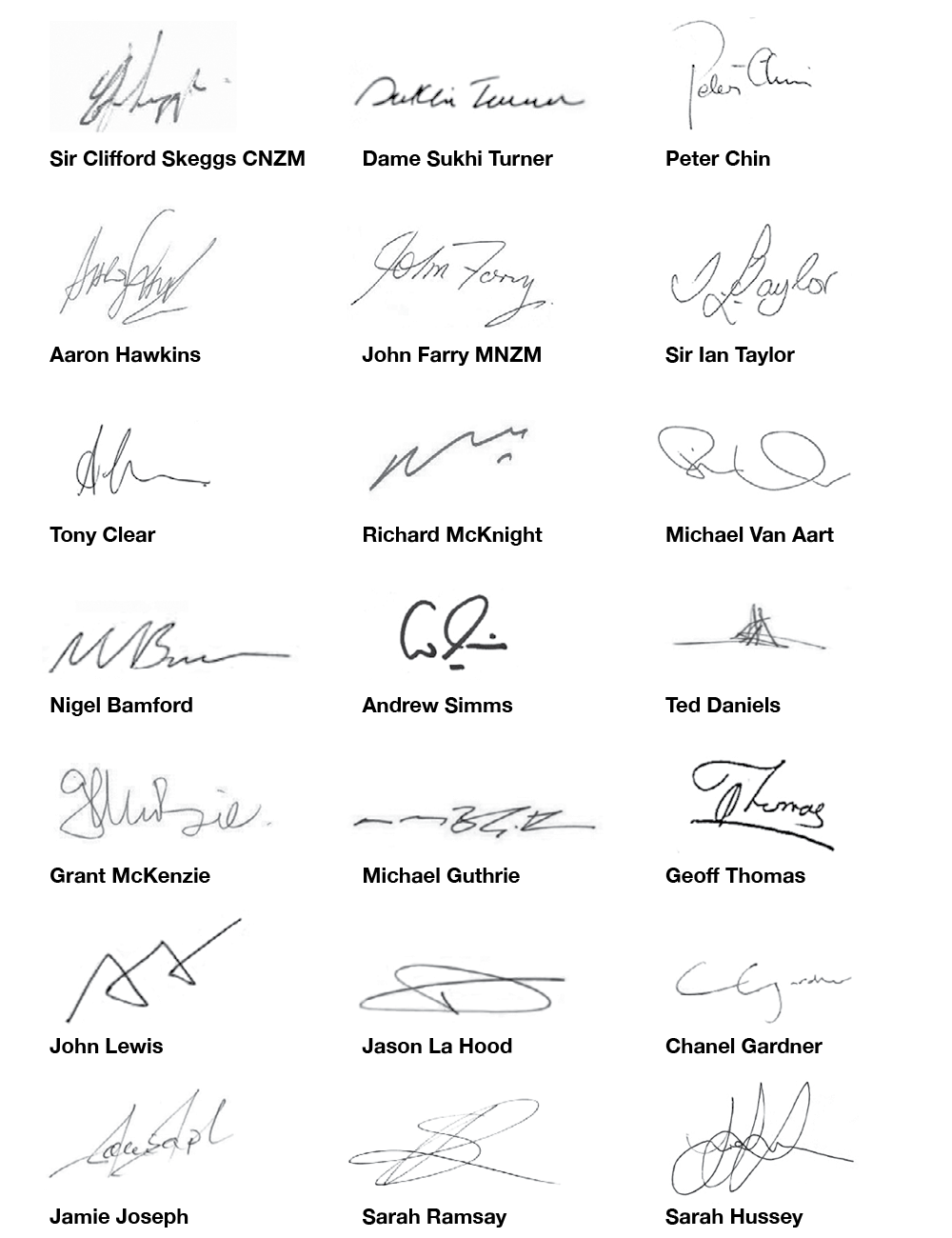

Sincerely, with respect.