After countless hours testing 20 FMA-regulated forex brokers, I've identified the best forex platforms for New Zealand traders.

My rigorous testing focused on key aspects of forex trading platforms in New Zealand that you will need for successful trading. Features tested included trading costs, spreads, execution speed, platform features, market range and customer support - all essential elements for top-tier forex trading.

Below, I identify each top broker's key strengths to help you find the perfect platform for your trading style.

What Are The Best Forex Brokers in NZ?

After testing all FMA-regulated forex brokers, I’ve narrowed my list down to 6 of the best forex brokers in New Zealand based on my results. My results considered the forex trading platforms, the trading costs, trading conditions, and trading tools the brokers offer.

As part of my list, I only considered FMA-regulated brokers, which ensured that the broker can legally offer their services in New Zealand. It also means you can trust the broker both in the way they operate and in keeping your funds safe.

My top 6 forex brokers for 2025 are:

- BlackBull Markets: Best NZ Forex Broker Overall

- CMC Markets: Best Proprietary Trading Platform

- Plus500: Best Trading Platform for Beginners

- TMGM: Best Forex Broker for Low Spreads

- IG: Best Range of CFD Products

- Axi: Best MetaTrader 4 Trading Tools

1. BlackBull Markets – 2025 Best Forex Trading Platform

BlackBull Markets stood out for me based on the results of my testing. The broker had the fastest execution speeds of all the 36 MT4 brokers I compared it against.

In fact, BlackBull was not only the fastest NZ forex broker, but among the fastest forex and CFD broker options worldwide.

Other key BlackBull Strengths include:

- Lowest recorded spreads of any NZ broker on my list

- Choice of 5 platforms and forex trading apps

- 23,000+ CFD trading instruments

- 64 currency pairs and 11 cryptocurrencies

Let me share a little more insight with you about those execution speeds. I found that BlackBull was clocking execution speeds over 50% faster than those of the most popular broker in forex and CFD markets – CMC.

You can see the results of my tests in the table below:

Broker | Limit Orders Speed (ms) | Market Order Speed (ms) |

Blackbull Markets | 72 | 90 |

Axi | 90 | 164 |

TMGM | 94 | 129 |

CMC Markets | 138 | 180 |

IG | 174 | 141 |

"BlackBull Markets consistently delivers the fastest execution speeds among New Zealand forex brokers, which is crucial for reducing slippage costs," says Justin Grossbard, co-founder of CompareForexBrokers.

And how about the other aspects of the BlackBull trading experience? While I was checking the platform out, I was able to use three different trading accounts. The best choice for me is the ECN Prime account.

While this account has a high $2,000 USD minimum deposit, it does offer significantly lower spreads than the other NZ trading accounts I tested.

The EUR/USD, for example, averages 0.23 pips – combined with the $3.00 per lot commission, your trading fees are going to be around 15% cheaper than the industry average.

BlackBull also supports a decent suite of 4 trading platforms that can utilise the broker’s quick execution speed and ECN services. One of the best options in my opinion is MetaTrader 4. MT4 gives you access to automated trading features through Expert Advisors (EAs) and custom indicators to tweak your trading strategies.

Alternatively, you have the MT5, cTrader, and TradingView platforms. These platforms all offer depth of markets features, which take advantage of the broker’s ECN services by viewing the liquidity provider’s order book.

I found this helpful for finding strong areas to buy and sell into, and it should help you to time your trades better during the day.

Out of the New Zealand CFD brokers tested, BlackBull Markets is the only one directly regulated by the FMA – others depend on Australia's ASIC to protect New Zealander traders.

The broker is headquartered in New Zealand and offers 24/7 support through live chat. In my experience, I received local support that was prompt and knowledgeable, so these features should help you trade with confidence.

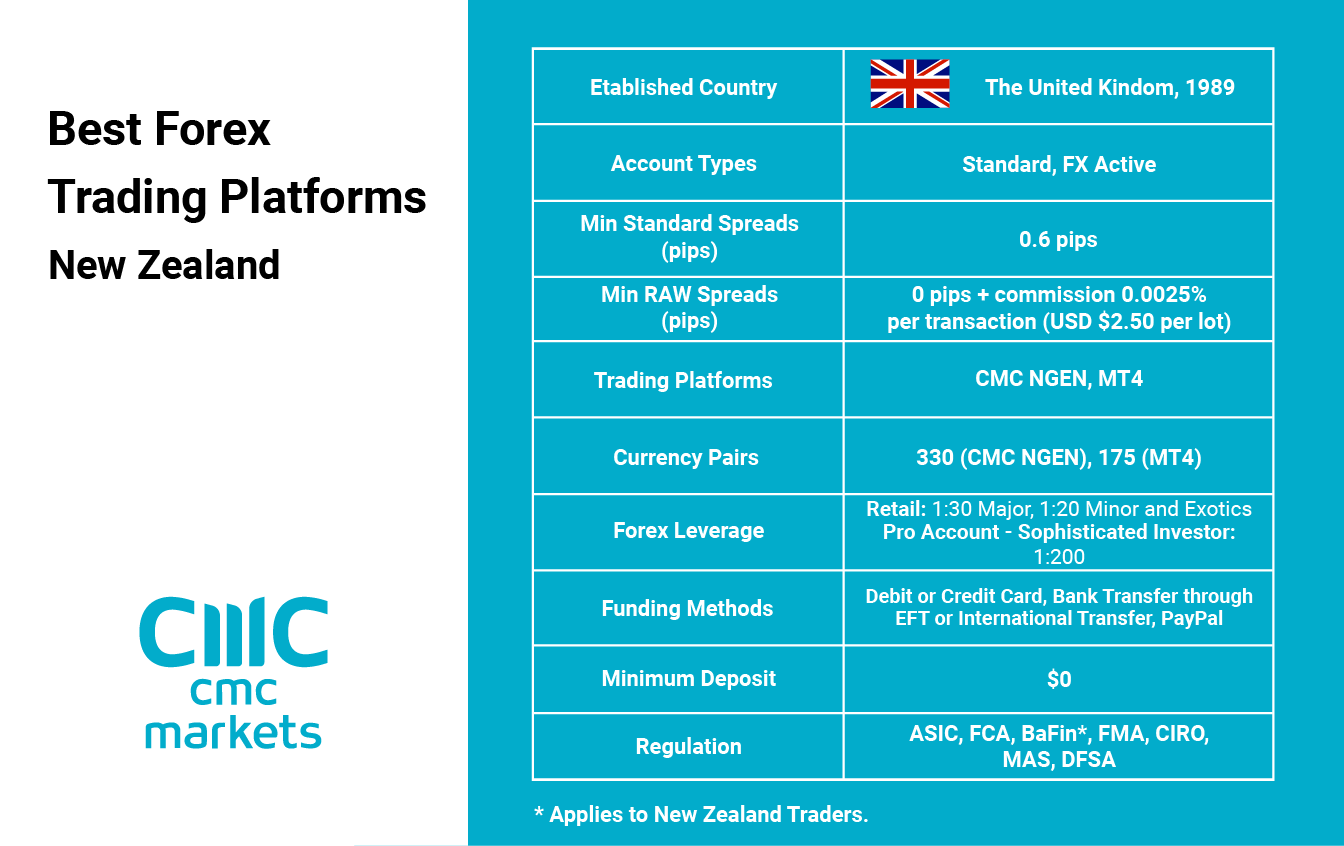

2. CMC Markets - Best Proprietary Trading Platform

CMC Markets scored highly for me due to its platform options. The broker's Next Generation platform is a competitive choice, but you also have the option to use popular third-party trading platforms like TradingView and MetaTrader.

Key strengths of CMC markets:

- NGEN trading platform

- 330 currency pairs to trade

- Guaranteed stop-loss (with NGEN)

- RAW spread trading with FX Active

Although I am a big fan of MetaTrader 4, let's look a little more closely at that NGEN platform, as this is unique to CMC. I found this platform to be a great all-rounder if you're focused on technical analysis. It supports over 110 trading indicators, from moving averages to stochastics and automated pivot points.

I was impressed with the platform's chart pattern recognition tool. The tool scans its CFD markets for 70 chart patterns, including wedges for breakout opportunities. I liked that you can use the tool to scan for specific patterns and markets, narrowing your selection to the markets you want to focus on.

Plus, each signal found generates a confidence rating based on the pattern’s success history, which I thought was a helpful indicator for new forex traders.

"CMC Markets' pattern recognition technology gives traders a significant edge in identifying reliable trading opportunities," says Noam Korbl, co-founder of CompareForexBrokers.

Features available on the Next Generation platform include:

- Advanced technical analysis tools

- 12,000+ CFDs

- Over 330 currency pairs

- Desktop and mobile apps for iOS and Android devices

- Risk management tools such as stop-loss order types

- Client sentiment data and fundamental analysis tools

- Deposits and withdrawals via debit card, credit card, bank transfer, and e-wallets like PayPal and Skrill.

While testing the platform, I found CMC Markets offers an impressive 330 forex pairs, ensuring you have access to pairs involving major currencies like the NZD, AUD, GBP, and USD.

Beyond the foreign exchange market, you can trade 12,000 CFDs, covering indices, shares, ETFs, commodities, treasuries, and even cryptocurrencies, providing New Zealanders with a solid multi-asset trading experience.

If you focus on forex trading, you should pick the FX Active account which has a 25% spread discount on its 300 forex pairs, and spreads from 0.0 pips.

You pay a small commission of $2.50 per lot traded, but this is surprisingly low compared to the rest of the NZ brokers I’ve tested.

CMC Markets is regulated around the globe including the FMA (NZ), ASIC (Australia), BaFin (Germany), FCA (UK), MAS (Singapore), and CIRO (Canada).

3. Plus500 - Best Trading Platform For Beginners

I found Plus500’s web platform to have the easiest interface to use. It doesn’t overcomplicate the screen with notifications and news feeds.

Plus500 account features:

- Free demo account

- Low trading fees and minimum deposit

- An easy-to-use trading platform

- Guaranteed stop-loss orders

- No commissions

Although the user interface is simple, I found the platform was still packed with all the typical features you’d expect from an advanced trading platform, and even a few more.

You can set up your charts with indicators like Bollinger Bands, as well as 100+ other indicators to help you build your trading strategy.

Plus500 offers +insights for its mobile trading app and desktop app, which I think is a useful tool for beginners.

This tool lets you discover trends and trading activity from other Plus500 traders, giving you insight into market sentiment – for example, whether forex traders are bullish or bearish in certain markets.

I found the spreads from Plus500 to be decent for forex trading. My tests found spreads starting from 0.80 pips on EUR/USD, which is below the industry average of 1.11 pips.

To start trading with Plus500, the broker does require a minimum deposit of $100. I actually don't think this is too bad, even for beginner traders. You can still trade with this deposit, and it'll only cost you $33 to open a micro-lot position with 1:30 leverage available.

This is a low leverage compared to other brokers I analysed. BlackBull Markets, for example, has a much higher maximum leverage. But a low leverage is good for beginners, as it will reduce your risk.

You also have access to 2,800+ financial markets including 60+ forex markets, 30 indices, 1,100+ shares and 12+ commodity markets. I felt that Plus500 offered plenty of asset classes, helping you find the best market for your trading style.

Plus500 is regulated to provide New Zealand traders through the Financial Service Providers Register (FSP) through the FMA. In addition, Plus500 is regulated by other top-tier regulators like ASIC (Australia), MAS (Singapore), and FCA (UK) and offers negative balance protection.

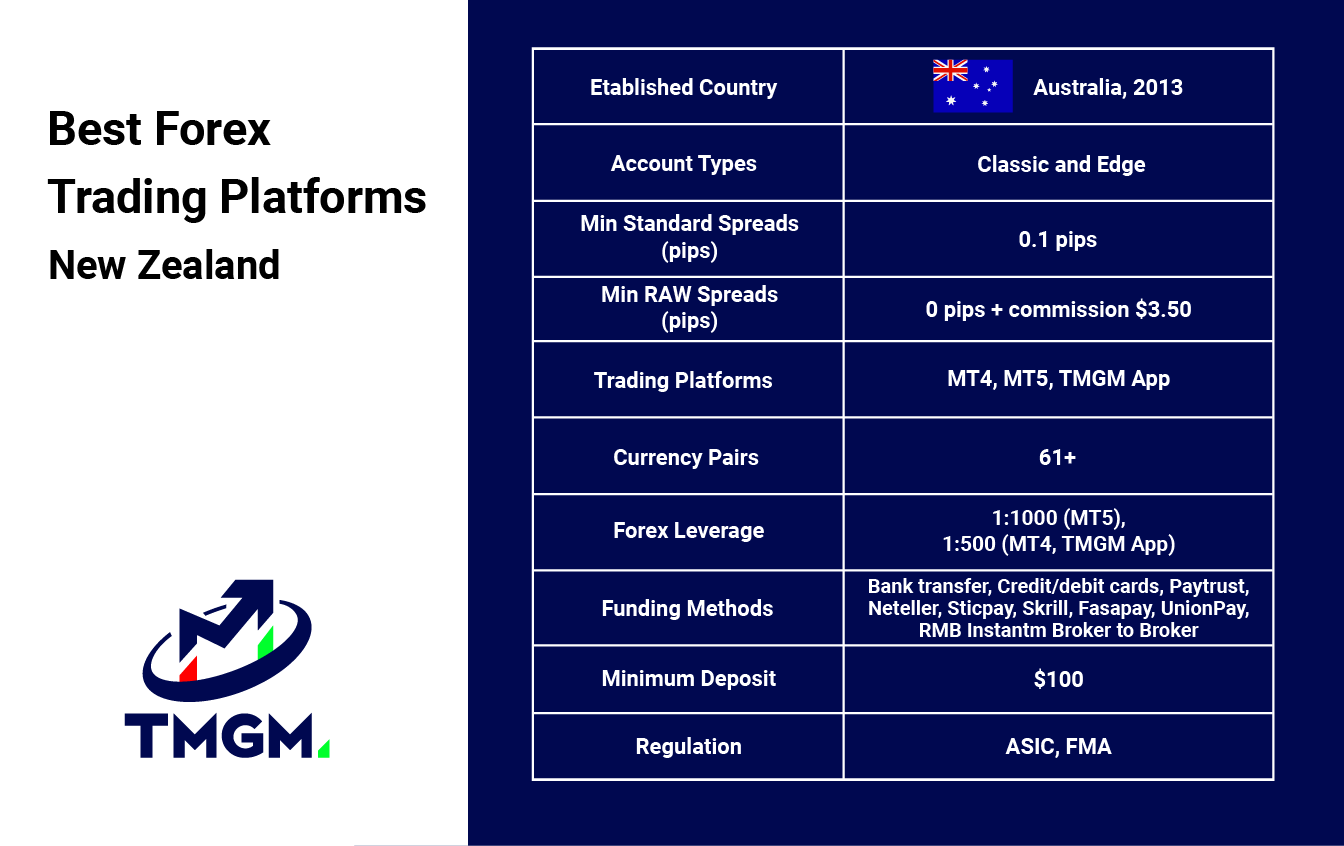

4. TMGM - Best Broker for Low Spreads

TMGM (Formerly TradeMax Global Markets) stood out in my testing after posting consistently low spreads. These spreads start from 0.0 pips on forex major pairs with the TMGM Edge account.

In fact, during my testing, I found that the broker offered zero-pip spreads on EUR/USD 100% of the time (outside rollover). This pattern was repeated across some of the other pairs I tested too.

Key features of TMGM include:

- No dealing desk execution

- ECN trading environment

- Low spreads from 0.0 pips

- The option of MetaTrader 4 and MetaTrader 5

- Direct Market Access

With zero-pip spreads, you’ll only pay a commission when you trade ($3.50 per lot). This means your trading costs are fixed, which can be an advantage in times of high volatility.

Here are some of the results of my tests. You can see how often TMGM was able to offer 0.0 pip spreads, represented as a percentage.

Broker | AUDUSD | EURUSD | GBPUSD | USDCAD | USDCHF | USDJPY | Average |

TMGM | 100.00% | 100.00% | 100.00% | 95.65% | 95.65% | 95.65% | 97.83% |

TMGM can provide these low spreads as it is an ECN broker. This just means it connects with other market participants to provide liquidity. With more competition for your order, you’ll get the best prices and tight spreads, which is why I prefer ECN brokers over market makers.

If you'd rather keep your trading costs simple through spread-only pricing, I found that TMGM's Classic trading accounts offer this.

The spreads start from 1 pip on EUR/USD, placing the account in line with the industry average. Of course, this makes it about 30% more expensive than the Edge account.

Either way, I think you are still getting great value from TMGM, especially with access to 17,000 financial markets on tight spreads. I also like that both accounts only require a $50 minimum deposit, so you can enjoy the Edge account’s benefits without putting too much money down.

The broker offers the MetaTrader 4 and MetaTrader 5 platforms. For me, MT5 is the optimal choice if you want to maximise your trading, as it gives you access to all the markets on TMGM.

Additionally, it has depth of market tools that allow you to view the ECN order flow. This is an excellent feature, as it adds another layer of market analysis, and helps you use trading volume to time your trades better.

As a bonus, I liked that TMGM offers a range of trading signal providers through Trading Central and Acuity to help you find trading ideas throughout the day automatically.

Both are available as MT4/MT5 plugins for ease of access on the third-party platforms, so you can receive alerts and review the signals without switching applications.

5. IG Group - Best Range Of CFDs

IG Group is the largest broker I’ve tested for this list, with 17,000+ CFD markets. This puts IG among the best brokers if you're trading on multiple markets, in my opinion.

You can trade traditional markets, like 80+ forex pairs, 130 indices (the biggest range I found), 40+ commodities, ETFs, and 12,000+ shares covering AU, US, UK, EU, and Asian markets.

IG features:

- 17,000+ CFDs with futures and options markets

- A wide range of 80+ forex pairs

- Multiple trading platforms including MT4 and ProRealTime

- Risk management tools including GSLOs

One of the standout IG features for me is its futures and options markets, allowing for more flexible trading strategies with limited downside and unlimited upside potential.

If you’re an experienced trader, options are a great way to profit from market volatility and price direction without the fear of getting your position closed by a stop loss.

The only way I found you can trade all of these markets on IG is through the broker's own IG Trading platform. This is a web-based platform, and has some advanced charting tools.

I found that the platform gives you access to 19 drawing tools and 30+ indicators like Ichimoku so you’ll still be able to perform decent technical analysis with IG Trading.

As for fundamental analysis, IG provides some of the best sources for you as a trader. There is breaking news provided through feeds like Reuters, and in-house analysts providing real-time commentary to keep you in the loop.

If you need more indicators or want to leverage the benefits of automated trading, IG Group also offers MetaTrader 4 and ProRealTime.

MetaTrader 4 is one of my top platform picks, as it is well supported by a large community of traders, creating Expert Advisors to automate your trades.

ProRealTime offers an easier approach for those without programming experience, using a built-in wizard to create strategies through a code-free interface.

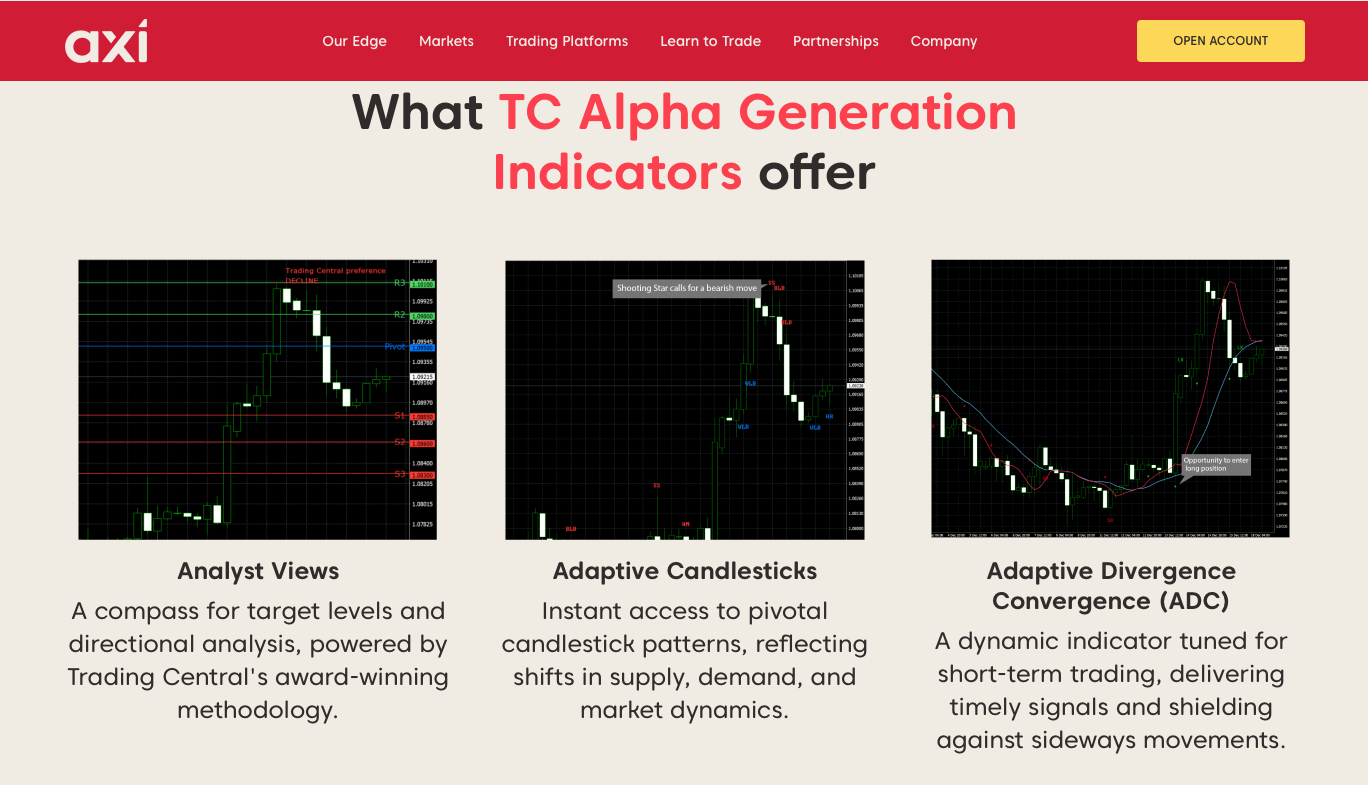

6. Axi - Great MetaTrader 4 Trading Tools

I always find MetaTrader 4 to be a decent platform, but Axi enhances its benefits with advanced management and sentiment trading tools through MT4 NexGen.

The sentiment indicator gives you insights into Axi’s client trading activity to help gauge whether traders are going long or short, which is useful for analysing confirmation bias.

Axi features:

- Free trading tools for MetaTrader 4

- Tight spreads from 0.0 pips

- Low commission on Elite account

- 1:500 leverage

If you scalp the markets, the Mini Terminal is a great addition as it tailors your one-click trading with built-in trade management features. These features are lacking on MT4’s default option. I like that you can attach your stop loss and take profit levels to your instant order, saving you valuable time when using one-click trading.

To further support the MT4 platform, Axi provides additional plugins from multiple trading platforms and signal providers including, Trading Central and Autochartist. These are top technical analysis providers that scan the markets using price action and chart patterns (like wedges or triangles) to find trading opportunities with professional market commentary.

Axi offers 3 trading account types, giving you a choice if you wish to use a spread-only or spread + commission pricing model. The Standard account offers spreads from 0.90 pips but no commission, while the Pro account has spreads from 0.0 pips and $3.50 per lot traded.

Based on my experience, the Pro account is slightly cheaper overall thanks to the lower spreads even though you are paying a commission. However, the lowest trading fees come with Axi's Elite account. At 0.0 pips and a $1.25 commission, the account is ideal for high-volume traders.

The Elite account does have a $25,000 minimum deposit requirement, which I agree is a lot. However, I think this is worth it if you can afford the deposit, considering how much you’ll save in commissions over your time with Axi.

If you cannot afford the $25,000 deposit, I found that both Standard and Pro accounts have $0 minimum deposit requirements.

FAQs

What is the Best Broker in NZ?

The best brokers in New Zealand offer top trading platforms, low spreads, and a diverse range of CFDs, as well as regulatory oversight from the Financial Markets Authority (FMA). Based on my analysis, BlackBull takes the top spot as the best forex broker in NZ for 2025, thanks to tight spreads, fast execution on MT4 and MT5, and 23,000+ markets.

CMC Markets was second on my list, due to its advanced proprietary software and trading tools, while Plus500 came in third as the best option for novice traders.

You can read more about the criteria used to determine the top brokers on our top NZ broker list.

What Forex Trading Platforms to Use in NZ?

MetaTrader 5 is my favourite forex trading platform to use in NZ as it offers a solid trading experience for all trader types, from beginners to automated traders.

The platform comes packed with features including an easy-to-use interface, 30+ trading indicators, and depth of market tools across multiple assets. It also offers automated trading with Expert Advisors, improving on the capabilities of MetaTrader 4.

Other top forex trading platforms available include cTrader and TradingView for technical analysis, while ZuluTrade and Myfxbook are solid options for copy trading.

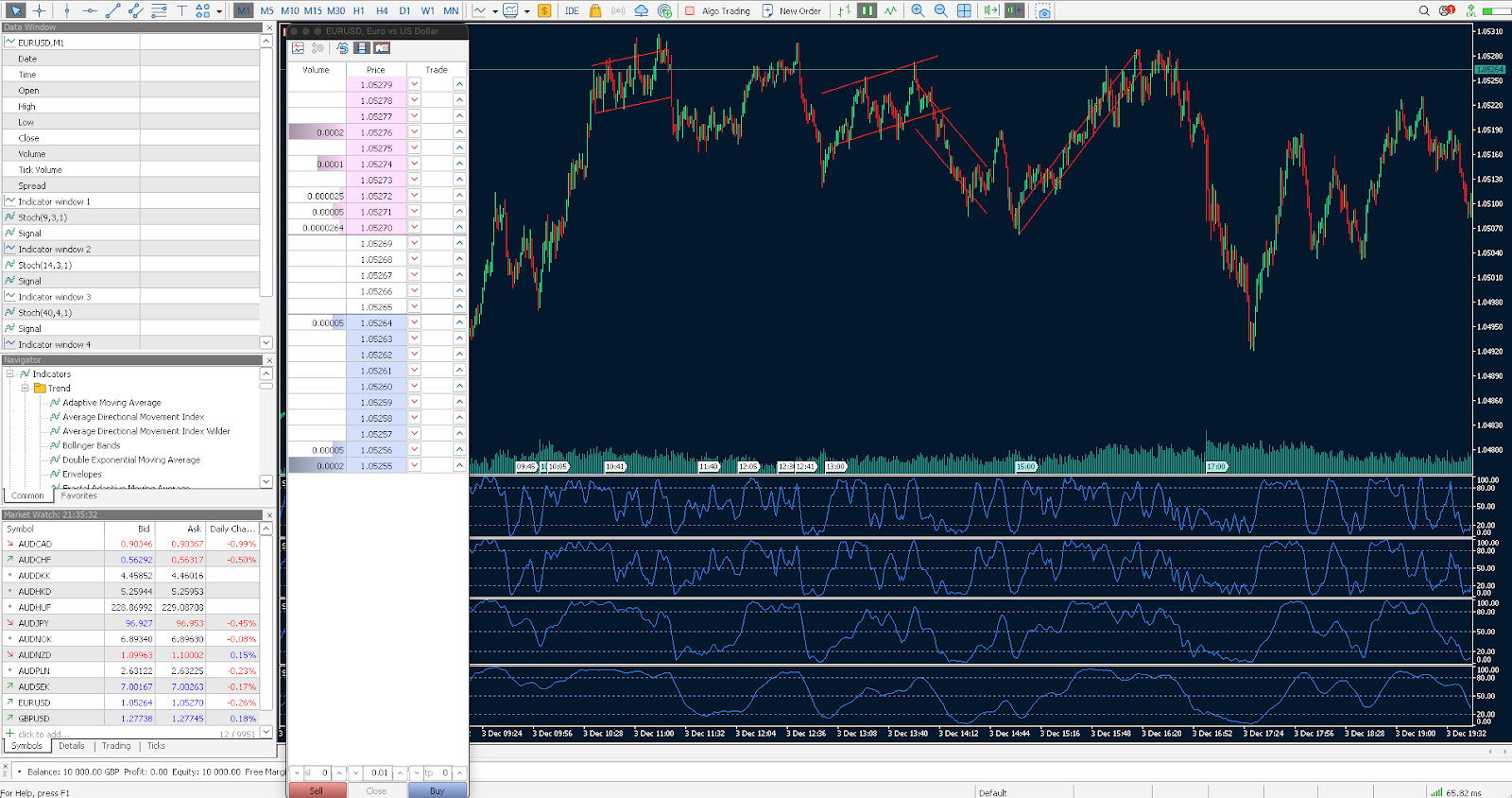

What are MetaTrader 4 (MT4) & MetaTrader 5 (MT5)?

MetaTrader 4 (MT4) & MetaTrader 5 (MT5) are trading platforms that let you view your broker’s price feed and give you a tool for executing trades. Both platforms provide advanced charting capabilities with 30+ technical analysis tools and drawing tools.

In addition, both MT4 and MT5 provide automated trading features where you can create Expert Advisors (EAs) to follow your trading strategy and execute trades automatically.

MT4 and MT5 are available as desktop applications, where all of their features are available. However, there are other platform options too, like a web browser (web trader), and mobile mobile trading apps for iOS and Android which let you manage and execute trades on the go.

That said, the mobile app variants of MT4/MT5 lack automated trading and custom indicators.

What is the Difference Between Social and Copy Trading?

The main difference between social and copy trading lies in how the trades are executed. Copy trading involves mirroring an experienced trader, replicating their entry and exit price automatically in real-time.

Social trading is where you engage with other traders who share potential ideas for you to analyse and execute based on your own analysis.

What are Examples of Social and Copy Trading Platforms?

Popular examples of copy trading platforms are eToro, DupliTrade, Signal Start by MyfxBook and ZuluTrade. Some brokers make their own copy trading apps such as Copy Trading by Pepperstone.

All these copy trading tools aim to make it easy for you to find traders that match your risk profile in the network of signal providers. You then follow the provider and give instructions when to have the providers trades copied.

What is Forex Trading?

Forex trading is when you buy and sell foreign exchange currency pairs to make a profit from the change in the exchange rate.

Through the use of CFDs, you can go long (buy) and short (sell), to potentially profit in bullish, bearish, or consolidating market conditions.

The forex market stands as the largest and most liquid financial market you can trade, with a daily trading volume of $6.6 trillion per day.

To trade the forex market you need a regulated forex broker. This broker acts as an intermediary, connecting you to liquidity providers.

In the forex trading industry, you use this exchange rate to speculate on whether the price will rise or fall. Forex pairs are broken down into three categories:

- Major Currency Pairs: Major forex pairs like EUR/USD, GBP/USD, and USD/JPY are the most traded globally. Their high liquidity and low spreads make them popular among traders.

- Minor Currency Pairs: Pairs like EUR/GBP provide opportunities to speculate on the relative strengths of major economies without the influence of the USD

- Exotic Currency Pairs: These pairs couple a major currency and one from an emerging economy, offering the potential for significant returns due to the volatility of emerging markets

What are CFDs?

Contracts for Difference (CFDs) are financial derivatives that allow you to profit from price movements without owning the underlying asset. CFDs are a great product to trade as they can result in profits during bullish, bearish, and ranging markets, depending on the position you open.

This is a marked difference to traditional investments, where you can only profit during bullish markets.

CFDs also utilise leverage, which varies for each New Zealand broker. This allows you to profit from smaller market movements making them a decent tool for day trading.

Is Forex Trading Legal in New Zealand?

Yes, forex trading is legal in New Zealand. The Financial Markets Authority (FMA) oversees New Zealand's forex and CFD trading, prioritising transparency, fairness, and retail investor protection.

The FMA aligns with global frameworks, like those used by the ASIC, FCA (formally the FSA), CySEC, FSCA, and MAS. New Zealand forex brokers must obtain a derivatives license from the FMA.

We also have a definitive list of Australian Brokers in 2025 that takes into considering similar criteria from trading fees to customer service levels.