Best MT4 Brokers for Forex Trading

In our search for the best MetaTrader 4 (MT4) brokers for New Zealanders, we focused on critical factors like fast execution speeds, low spreads, and a comprehensive range of MT4 trading tools, all under the stringent oversight of Financial Markets Authority (FMA) regulation. Through our thorough research, we found the best FMA-regulated brokers offer execution speeds up to 46% faster than the industry average, while others provide access to spreads that are up to 55% tighter.

Based on our analysis, the six best MT4 brokers are:

- BlackBull Markets - Best MT4 Forex Broker

- TMGM - Best MT4 Broker for Low Spreads

- Axi- Best for Cryptocurrency Trading on MT4

- CMC Markets- Best MT4 Charting Tools

- IG Trading - Best MT4 Broker for Beginner Traders

- RockGlobal Markets - NZ Forex Broker for MT4

In New Zealand,FMA regulation ensures broker reliability and trader protection. All brokers listed in this guide are FMA-regulated, providing an added layer of security and trust for New Zealand traders.

1. BlackBull Markets - Best MT4 Broker Overall

BlackBull Markets, a New Zealand-based forex broker, is recognised for its world-class MetaTrader 4 trading conditions. They stand out with execution speeds 35-46% quicker than the industry averages, marking them as one of the fastest brokers globally.

In addition to their rapid order execution, BlackBull Markets offers an extensive selection of over 26,000 CFDs. This variety, along with their adaptable account types with standard and raw spreads and a comprehensive range of MT4 add-ons, establishes BlackBull Markets as an ideal choice for traders looking for a reliable and versatile trading platform.

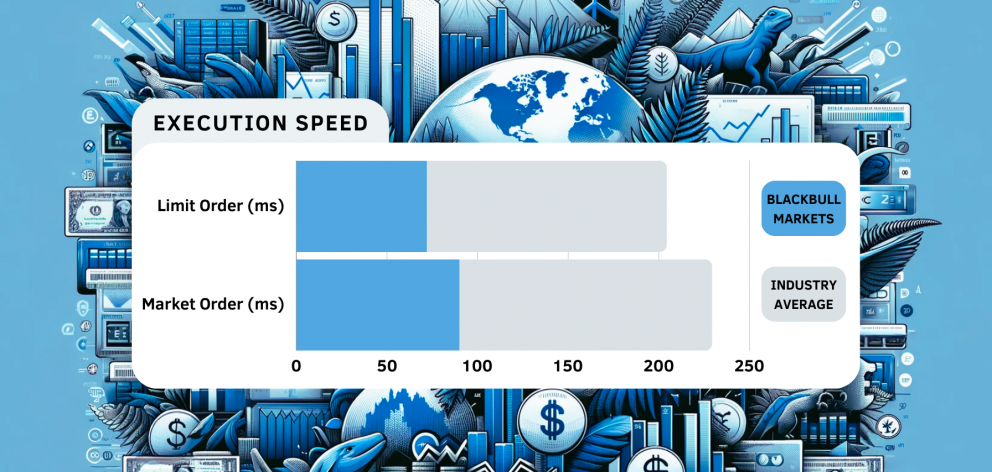

Fastest Execution Speeds

In examining BlackBull Markets' execution speeds, they demonstrate one of the fastest performances in the global forex market. My evaluation of BlackBull Markets' execution speeds is grounded in a methodical approach involving comprehensive testing under a range of trading scenarios. This rigorous process ensures a solid foundation for comparing and assessing their performance against industry standards.

The data I collected speaks volumes: BlackBull Markets achieves a limit order speed of 72 ms and a market order speed of 90 ms. Compared to the industry average, BlackBull Markets' performance is approximately 46% faster for limit orders and 35% faster for market orders. This significant speed advantage is crucial for traders aiming to minimise slippage and maximise the potential for timely and effective trades.

Pepperstone follows with slightly slower speeds. Axi, another FMA-regulated broker in New Zealand, records a market order speed of 164 milliseconds, approximately 82% slower than BlackBull Markets' 90 milliseconds.

Broker | Ranking | Limit Order Speed | Market Order Speed |

BlackBull Markets | 1 | 72 | 90 |

Pepperstone | 2 | 77 | 100 |

Axi | 3 | 90 | 164 |

TMGM | 4 | 94 | 129 |

FP Markets | 5 | 225 | 96 |

IC Markets | 6 | 134 | 153 |

CMC Markets | 7 | 138 | 180 |

IG | 8 | 174 | 141 |

Industry Average | 132.5 | 139.5 |

MT4 Trading Tools

BlackBull Markets offers an enhanced trading experience on the MetaTrader 4 (MT4) platform, known for its user-friendly interface, advanced charting capabilities, and comprehensive technical analysis tools. The platform is available as a desktop app (Windows and Mac), a webtrader platform, or trading apps (iOS and Android).

At BlackBull Markets, the MT4 platform is equipped with extensive charting tools and a broad range of technical indicators, allowing for in-depth market analysis and trading strategy development. Additionally, the platform's interface is highly customisable. Traders can adjust the layout to align with their trading styles and preferences, improving usability and personalising the trading experience.

Noam Korbl, a key figure at CompareForexBrokers, discusses the capabilities of BlackBull Markets MT4 offering. “It's packed with extensive charting tools and a wide array of technical indicators, perfect for those deep dives into market analysis and honing your trading strategies. Plus, the platform is highly customisable. Traders can tweak the layout to suit their style and preferences, making it more user-friendly and tailored to their trading journey.”

A key feature of BlackBull Markets' MT4 offering is the support for automated trading through Expert Advisors (EAs). This functionality is especially beneficial for traders who prefer to execute strategies without constant manual oversight, allowing for a more efficient trading process.

BlackBull Markets enhances the MT4 experience with several valuable add-ons:

- VPS Trading: Virtual Private Server (VPS) trading allows for uninterrupted trading, which is essential for running automated trading strategies. It ensures that trades are executed even when your local machine is off.

- FIX API Trading: For forex traders needing faster and more reliable execution, FIX API Trading provides a direct connection to market liquidity providers. This is particularly beneficial if you are a high-frequency trader.

- Autochartist: This tool automatically identifies potential trade opportunities based on chart patterns. It's a valuable trading tool for those who rely on technical analysis.

- Myfxbook: This is a social trading tool that allows traders to track, compare, analyse, and share their trading activities with other traders.

- ZuluTrade: A platform for copy trading where traders can follow and copy the trades of experienced traders. This particularly appeals to beginners or those looking to diversify their trading strategies.

These add-ons enhance the MT4 platform's capabilities, offering BlackBull Markets' clients a more versatile trading experience. These tools cater to a wide range of trading needs and preferences through advanced technical analysis, automated trading or copy trading features.

Pricing and Fees

BlackBull Markets offers a range of account types on MetaTrader 4, each catering to different trading needs and styles:

- ECN Standard: Ideal for beginners or those trading smaller volumes. Forex spreads start from 0.8 pips with no commission fees and no minimum deposit, making it accessible and cost-effective for new traders.

- ECN Prime: Suited for experienced traders who handle larger volumes. This account offers raw spreads from 0.1 pips with a USD 6 round turn commission per lot per 100k traded. A minimum deposit of USD 2,000 is required.

- ECN Institutional: Designed for professional and institutional traders. It provides the tightest spreads, starting from 0.0 pips, and a lower commission of USD 4 round turn per lot per 100k traded. The higher minimum deposit of USD 20,000 reflects its suitability for high-volume, serious traders.

MetaTrader 4 is available across all these account types, ensuring traders can access its comprehensive tools and features, regardless of their chosen account.

Financial Instruments

BlackBull Markets provides a broad spectrum of trading opportunities with access to over 26,000 CFDs on the MetaTrader 4 platform. Traders can explore a variety of asset classes, including forex, commodities, shares, and indices.

Final Verdict on BlackBull Markets

BlackBull Markets provides a high-quality MetaTrader 4 trading experience, marked by their fast execution speeds and extensive selection of CFDs. Their blend of speed, MT4 trading tools, and customisable account options position them as a reliable FMA-regulated broker.

2. TMGM - Best MT4 Broker for Low Spreads

Based in Sydney, Australia, TMGM offers ultra-tight spreads on the MetaTrader 4 platform. Known for being a low spread forex broker with an ECN pricing model, TMGM ensures competitive and transparent pricing through both commission and commission-free account types. Their MT4 platform is further enhanced with the integration of Acuity Trading tools, offering a comprehensive trading experience for New Zealand traders.

Competitive ECN Pricing

TMGM is recognised for its competitive pricing, operating as an Electronic Communication Network (ECN) broker. This model ensures direct access to other market participants, including banks and liquidity providers, leading to lower spreads and more transparent pricing for traders.

TMGM offers two main account types to suit different trading needs:

- Classic Account: standard spreads and no commission fees, well-suited for beginner traders who prefer simplicity in cost structure.

- Edge Account: tighter raw spreads with a commission fee, designed for high-volume traders and those wanting to reduce trading costs.

The methodology for determining the best forex spreads involved thoroughly analysing both standard and ECN spreads. This process included comparing spreads across various online brokers and evaluating the cost-effectiveness and transparency of their pricing structures.

Classic Account Commission-Free Spreads

TMGM's average standard spreads for the major currency pairs shown below demonstrate the Australian broker's competitive edge. For EUR/USD, TMGM's spread of 1 pip is nearly 20% lower than the industry average of 1.24 pips. In the case of AUD/JPY, TMGM offers a spread of 1.44 pips, 35% lower than the industry average of 2.21 pips.

Overall, TMGM's spreads are consistently lower than the industry averages for these key pairs, underscoring their commitment to competitive ECN pricing in the forex market.

Online Broker | EUR/USD | USD/JPY | USD/CAD | EUR/JPY | AUD/JPY |

TMGM | 1.00 | 1.09 | 1.28 | 1.30 | 1.44 |

BlackBull Markets | 1.20 | 1.30 | 1.50 | 1.90 | 2.10 |

CMC Markets | 1.12 | 1.38 | 1.32 | 1.55 | 1.80 |

Axi | 1.20 | 1.10 | 1.30 | 1.20 | 1.40 |

IG | 1.13 | 1.12 | 1.98 | 2.27 | 1.62 |

Pepperstone | 1.12 | 1.47 | 1.50 | 2.10 | 1.70 |

Plus500 | 1.70 | 1.90 | 2.00 | 2.40 | 3.00 |

Industry Average | 1.24 | 1.44 | 1.82 | 1.95 | 2.21 |

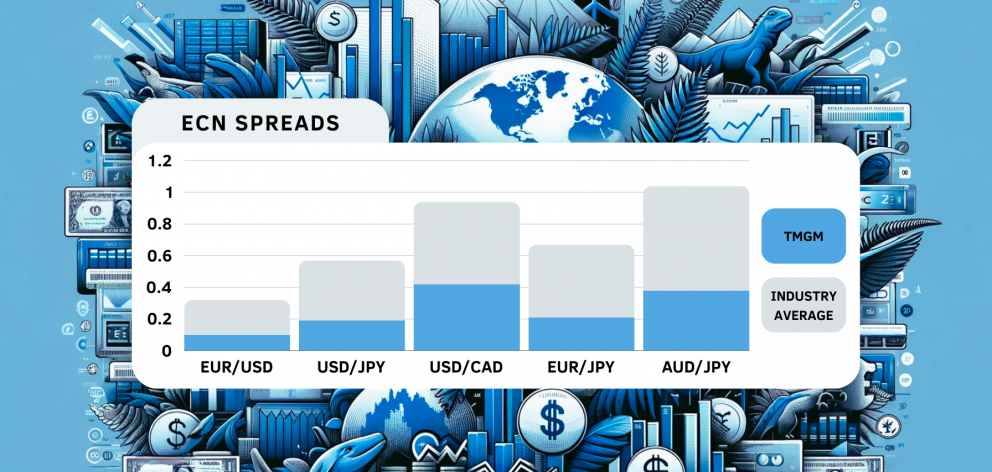

Edge Account ECN Spreads

TMGM's Edge Account, with a commission of $3.50 per side per 100k traded, presents an appealing option for active traders. In the EUR/USD pair, TMGM offers a competitive spread of 0.1 pips, approximately 55% lower than the industry average of 0.22 pips.

Similarly, for pairs like AUD/USD and USD/JPY, TMGM maintains spreads over 50% lower than the industry average.

Online Broker | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD |

TMGM | 0.1 | 0.19 | 0.42 | 0.21 | 0.38 |

BlackBull Markets | 0.23 | 0.6 | 0.72 | 0.65 | 0.66 |

CMC Markets | 0.5 | 0.7 | 0.9 | 0.6 | 1.3 |

Axi | 0.44 | 0.2 | 0.85 | 0.42 | 0.83 |

IG | 0.16 | 0.24 | 0.59 | 0.29 | - |

Pepperstone | 0.1 | 0.6 | 0.6 | 0.3 | 0.6 |

Industry Average | 0.22 | 0.38 | 0.52 | 0.46 | 0.66 |

MT4 Trading Experience

TMGM offers a solid MT4 trading experience, combining user-friendly functionality with powerful features. Their MT4 platform is equipped with advanced charting tools, a wide array of technical indicators, and the capability for automated trading through Expert Advisors (EAs).

Additionally, TMGM integrates Acuity Trading tools into their MT4 platform, providing traders with an innovative market news and sentiment analysis tool. This feature offers insightful market data and trends, aiding traders in making informed decisions.

With one-click trading, real-time market execution, and access to diverse markets such as forex, indices, equities, and commodities, TMGM's MT4 platform is tailored to meet the needs of both beginner and experienced traders.

Verdict on TMGM

TMGM provides an ECN trading environment with low spreads and transparent pricing. Combined with a feature-rich MT4 platform, they are well-suited for traders who value cost efficiency and sophisticated trading tools.

3. Axi - Best MT4 Broker for Crypto Trading

Axi, an Australian broker, offers a wide range of cryptocurrencies on MT4. Unlike many CFD brokers whose MT4 offerings in the crypto space are limited, Axi provides a much broader array of digital currency options. This makes Axi an ideal choice for traders looking to explore the crypto market on a familiar and reliable MT4 platform while also having access to a wide variety of other trading instruments.

Cryptocurrency CFDs

Axi offers a dynamic range of cryptocurrency CFDs, allowing traders to engage in the crypto market without needing a digital wallet. Their platform supports trading in 30 popular cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more.

Key features of Axi's cryptocurrency CFD trading services include:

- Leverage: Axi provides 2:1 leverage on cryptocurrency trades.

- Go Long or Short: Traders can profit from rising and falling markets, offering flexibility in trading strategies.

- No Digital Wallet Required: Axi eliminates the complexities of managing a digital wallet, enabling traders to focus on market movements.

- Zero Commission: Trading cryptocurrencies with Axi incurs no commission fees, making it a cost-effective option.

- 24/7 Trading: All coins are available for trading around the clock, ensuring traders can respond to market changes at any time.

- All Trading Strategies Allowed: The ability to use Expert Advisors (EAs) and implement algorithmic trading strategies, providing flexibility in trading approaches.

- Competitive Spreads: Tight spreads combined with zero commission fees.

Market Access to Other Assets

Axi provides a comprehensive range of 220+ CFD trading options catering to various interests and trading strategies. Traders can engage in the forex market with a wide selection of currency pairs, benefiting from competitive spreads and the potential for low-cost trading.

In the realm of shares, Axi offers over 100 share CFDs from the US, UK, and European markets. This includes the opportunity to trade on popular stocks like Amazon, Tesla, and Netflix, with the added advantage of zero commission on share CFD trades. Traders can also explore the latest global IPOs, gaining exposure to stocks as soon as they go public.

For those interested in indices, Axi provides access to over 30 major global indices with no commission fees, including markets from the US, UK, Europe, Asia, and Australia. You can also access a variety of popular commodities, including gold, silver, oil, and coffee.

Overall, Axi's diverse range of CFD trading options on the MT4 platform provides traders with numerous opportunities to engage in different markets, from forex and shares to indices and commodities.

MT4 Trading Accounts

Axi offers a tailored selection of MT4 trading accounts to accommodate various trader needs. From the commission-free Standard Account to the low-spread Pro and Elite Accounts, each option is designed to match different trading strategies and experience levels.

Axi Trading Accounts | Standard Account | Pro Account | Elite Account |

Spreads | From 0.9 pips | From 0 pips | From 0 pips |

Commission | $0 | $7 round turn | $3.50 round turn |

Minimum Deposit | $200 | $500 | $25,000 |

Verdict on Axi

Axi’s vast selection of cryptocurrency CFDs on MT4, far exceeding many competitors, positions it as a leading choice for traders focused on the crypto market.

4. CMC Markets - Best MT4 Charting Tools

CMC Markets is a top UK broker known for its extensive MT4 charting tools and add-ons. With a strong presence in the forex market since 1989, they have established themselves as a CFD broker that combines technological innovation with a deep understanding of trader requirements. Their MT4 platform, known for its advanced charting capabilities, is designed to offer an edge in market analysis and decision-making.

Forex Offering

CMC Markets offers a comprehensive MT4 trading experience with two account types: a commission-free account and the FX Active commission account. Traders have access to over 200 CFDs, including 175 forex pairs, key indices, commodities, and a selection of cryptocurrencies. This diverse range caters to various trading preferences and strategies.

MT4 Charting Tools

CMC Markets' MT4 platform is equipped with a range of in-built charting tools designed to enhance trading analysis. These tools include advanced charting capabilities, allowing traders to visualise market trends and patterns effectively. The platform also offers a variety of technical indicators,, which traders can use to analyse market conditions and make informed trading decisions. These in-built tools are essential for technical analysis, providing traders with the necessary resources to assess and respond to market dynamics.

CMC Markets also offers a suite of premium MT4 plugins that complement these core features, further expanding the platform's analytical and trading capabilities.

Examples of Premium MT4 Add-Ons:

- Mini Terminal: This add-on allows traders to place and modify pending orders directly from a chart, including smart lines for trend line stop-losses and take-profit orders.

- Trade Terminal: Offers enhanced order ticket functionality and access to quote panels, with the ability to set up alerts based on account activity.

- Sentiment Trader: Displays live and historical sentiment data from other traders, aiding in understanding market trends and trader behaviour.

- Order History Indicator: Visualises past trade entry and exit points on charts, showing stop-loss and take-profit orders for a clear historical perspective.

- Pivot Points Indicator: Adds pivot points to charts for technical analysis, with the option to set alerts based on pivot levels.

- Renko Indicator: Enables the overlay of Renko blocks on time-based charts and the creation of traditional non-time-based Renko charts.

Additional MT4 Features:

- Autochartist: Automatically scans the market for recognisable patterns, offering traders insights and potential trade opportunities.

- VPS (Virtual Private Server): Ensures uninterrupted trading, which is crucial for running automated strategies using Expert Advisors (EAs).

- MT4 Academy: Provides educational resources to help traders leverage the full potential of the MT4 platform.

These add-ons and features collectively enhance CMC Markets' MT4 platform, catering to a wide range of trading needs and preferences, from advanced technical analysis to efficient trade management and continuous learning.

Customer Support

For New Zealand traders, the local support offered by an international broker like CMC Markets is a significant advantage. Established in London in 1989, CMC Markets combines a wealth of experience with a knowledgeable customer service team available via live chat, phone, and email. This expertise is reinforced at their Auckland office, where the focus is on providing customised support tailored to the unique requirements of New Zealand clients.

Industry expert Justin Grossbard from CompareForexBrokers.com emphasises the benefits of CMC Markets' local customer support for New Zealand traders. “With their team on hand 24/5, traders get the help they need when they need it. What's more, CMC Markets makes it easy to book meetings online, either before or after signing up. This gives you the chance to really understand what you’re getting into and make choices that are right for you.”

Final Verdict CMC Markets

CMC Markets is a top choice for MT4 charting tools, offering an extensive range of features and add-ons that cater to traders focusing on technical strategies. Their commitment to technological innovation and tailored support for New Zealand clients make them a reliable and forward-thinking choice for Kiwi traders.

5. IG Trading - Best MT4 Broker for Beginner Traders

IG Trading is renowned for its beginner-friendly approach, offering an array of features on the MetaTrader 4 platform that are specifically designed to support and educate new traders.

Features for Beginner Traders

IG Trading offers a range of features that are particularly beneficial for beginner traders. These features include:

- Educational Materials: IG Trading provides a wealth of educational resources to help new traders develop their skills. This includes expert-led learning material, online courses for every skill level, and live sessions with experts. These resources are designed to help beginners understand the trading basics and develop effective strategies.

- Uncomplicated Account and Pricing Structure: IG Trading offers a straightforward account setup with no minimum balance required to open an account. Their main charge on each trade is the forex spread, making it easy for beginners to understand their cost structure.

- Limited Risk Accounts: Based on a trader's experience and financial circumstances, IG Trading may place them on a limited-risk account. This account type is designed to prevent new traders from being exposed to excessive risk.

- Guaranteed Stop Loss Orders: For traders on a limited-risk account, IG Trading requires a guaranteed stop to be added to each position before it can open. GSLOs are a great risk management tool to help beginners limit potential losses.

- Customer Support: IG Trading offers 24-hour customer service, including phone support, educational videos, guides, in-person seminars, live webinars, and a comprehensive glossary of trading terms. This support is crucial for beginners who may need assistance as they navigate the complexities of trading.

MetaTrader 4 Offering

Justin Grossbard from CompareForexBrokers.com shares insights on IG Trading's MetaTrader 4 platform. “It's a great starting point for anyone new to forex. IG's MT4 platform isn't just about forex; it also includes key global indices and popular commodities like gold and oil. They even offer cryptocurrencies like Bitcoin and Ether. This variety opens up a world of opportunities for new traders to explore different markets, all on a platform that's easy to navigate.”

Verdict on IG Trading

IG Trading’s comprehensive support and educational resources make it an excellent choice for beginner traders new to the MT4 platform, providing a user-friendly introduction to forex trading.

6. RockGlobal Markets - NZ Forex Broker for MT4

RockGlobal Markets, operating as Rockfort Markets Limited, is a New Zealand-based broker in Auckland, offering a solid local MT4 trading experience with advanced charting and risk management tools.

MetaTrader 4 Platform

RockGlobal Markets offers a comprehensive trading experience on the MetaTrader 4 (MT4) platform with two account types: Standard and Pro. Their MT4 platform is equipped with advanced charting capabilities and a variety of analytical tools, including a wide range of indicators and multiple timeframes for in-depth market analysis. Additionally, traders can engage in algorithmic trading using Expert Advisors (EAs) for automated strategies.

The platform supports trading in over 50 major forex pairs, indices, metals, and commodities, catering to a diverse range of trading interests and strategies.

RockGlobal's focus on advanced charting and risk management tools, such as micro lot position sizing, also makes it a suitable choice for traders looking for a detailed and controlled trading environment.

Verdict on RockGlobal Markets

RockGlobal Markets stands out as a reliable choice for MetaTrader 4 in New Zealand, offering a diverse range of instruments and trading tools for both new and experienced traders.

What are the best forex brokers for MT4?

BlackBull Markets emerges as the best overall MT4 broker, excelling with execution speeds up to 46% faster than the industry average and offering a diverse selection of over 26,000 CFDs. Their commitment to providing a versatile trading platform with advanced charting tools, customisable account types, and a range of MT4 add-ons positions them as a top choice for traders seeking reliability and variety in their trading experience.

Do I need a broker for MT4?

Yes, you need a broker to trade on the MetaTrader 4 (MT4) platform. MT4 is a trading platform that connects traders to the forex market, but it requires a broker to execute trades and provide access to market liquidity and instruments.

How do I get a MT4 demo account?

To obtain an MT4 demo account, simply register with a broker that offers the MetaTrader 4 platform. These demo accounts are ideal for beginners, as they simulate live trading conditions with a virtual balance, allowing for practice and learning without the pressure of real financial risk. This is particularly advantageous as beginners can start slow and learn at their own pace without the concern of inactivity fees often associated with live trading accounts.

Can you use MT4 on mobile?

Yes, you can use MetaTrader 4 (MT4) on mobile devices. Typically, brokers offering MT4 provide mobile trading apps for both iOS and Android platforms. These mobile apps allow traders to access their MT4 trading accounts on the go, offering a range of functionalities like real-time quotes, charting tools, and the ability to execute trades and manage their accounts from their smartphones or tablets.

What is MetaTrader 4 (MT4)?

MetaTrader 4 (MT4) is a popular online trading platform used by retail forex traders around the | and released in 2005. MT4 is known for its user-friendly interface, advanced charting capabilities, automated trading through Expert Advisors (EAs), and a wide range of technical analysis tools. It allows traders to analyse financial markets, perform advanced trading operations, run trading robots, and conduct copy trading.

What are Expert Advisors (EAs)?

Expert Advisors (EAs) are automated trading programs used on the MetaTrader platform to execute trades based on predefined strategies and rules. They can analyse market data and execute trades automatically, offering a hands-off approach to trading. EAs are created using MetaTrader's programming language and can be customised or downloaded. While they automate trading and can operate continuously, their effectiveness heavily depends on the quality of their programming and the strategies they are based on.

What is copy trading?

Copy trading is a strategy that allows traders to replicate the trades of experienced and successful traders automatically in their own trading accounts. This approach enables less experienced traders to benefit from the knowledge and strategies of more seasoned market participants, often through a platform that connects them. Copy trading can be a valuable tool for those new to trading or those looking to diversify their strategies by observing and learning from others' trading decisions.

What is leverage in forex trading?

Leverage in forex trading is a tool that allows traders to control larger positions with a smaller amount of capital, magnifying both potential profits and risks. In New Zealand, forex trading is regulated by the Financial Markets Authority (FMA), which permits higher leverage ratios of up to 500:1 for forex trading. This is similar to forex rules in offshore jurisdictions like Seychelles (FSA) and South Africa (FSCA).

This contrasts with countries like Australia, Europe, and the UK, where regulatory bodies such as ASIC, CySEC, and the FCA have imposed significantly stricter leverage limits, typically capping it at 30:1 for major forex pairs.

What does the FMA do in NZ?

The Financial Markets Authority (FMA) in New Zealand regulates foreign exchange and financial services, ensuring brokerage firms operate transparently and fairly. This regulatory body plays a crucial role in overseeing the forex trading industry, safeguarding the interests of both professional and retail investor accounts, and maintaining the integrity of financial markets in New Zealand.

What is the difference between MetaTrader 4 and MetaTrader 5?

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are both trading platforms developed by MetaQuotes, but they cater to different types of markets. MT4 is designed for decentralised markets, primarily focusing on forex trading, and is renowned for its large user community and extensive use of Expert Advisors (EAs) for automated trading. MT5, while similar in functionality and also supporting EAs, is tailored for centralised markets, including stocks and commodities.

Despite the advanced features of MT5, MT4 remains the most popular platform due to its user-friendly interface and strong community support, especially among forex traders.

What is the best forex trading platform?

MetaTrader 4 (MT4) is widely recognised as the most popular retail forex trading platform worldwide. Its user-friendly interface, advanced charting tools, and extensive support for Expert Advisors (EAs) for automated trading make it a top choice among both beginner and experienced traders.

In addition to MetaTrader 4, MetaTrader 5 (MT5), TradingView, and cTrader are also widely used platforms in the forex trading world. Furthermore, many brokers like Pepperstone, Interactive Brokers, and CMC Markets offer proprietary platforms with unique features. To learn more about other software, you can read about The Best Forex Trading Platform for New Zealand Traders.

Disclaimer

This content is for informational purposes only and should not be construed as financial advice. Trading in forex and derivatives carries a high level of risk. We recommend seeking advice from a professional financial services provider before making any investment decisions.