The latest set of economic forecasts predict worrying negative economic growth for the coming financial year, and that is not a situation that the government — or New Zealand Inc — can ignore.

Overall, real GDP declined in four out of the five quarters to December 2023 and it is not looking much better for the rest of this year. The effect on the economy has been similar to the global financial crisis.

Growth projections for subsequent years are rosier, but getting to anything like those forecast numbers will require a lot of crossing of fingers and wishing upon stars.

The previous government tried this approach too, of course, but many of its ‘‘shovel ready’’ projects did not get a digging tool anywhere near the ground anywhere near fast enough.

But Ms Willis has not put all her eggs in the roads and mines basket. Much of the infrastructure spend will be on classrooms and hospital wards, work which the government will hope it can get started relatively quickly and get that economic turnaround started.

Ideally she would have liked to get the books back in black faster — there is the small matter of an election scheduled for next year — but there are some hard numbers in this Budget.

Growth is predicted to remain slow to invisible worldwide, affecting how much money New Zealand earns from its most important export earner, milk.

Interest rates are expected to stubbornly remain high — the share of disposable income used for mortgage interest payments doubled between the end of 2021 and the beginning of 2024.

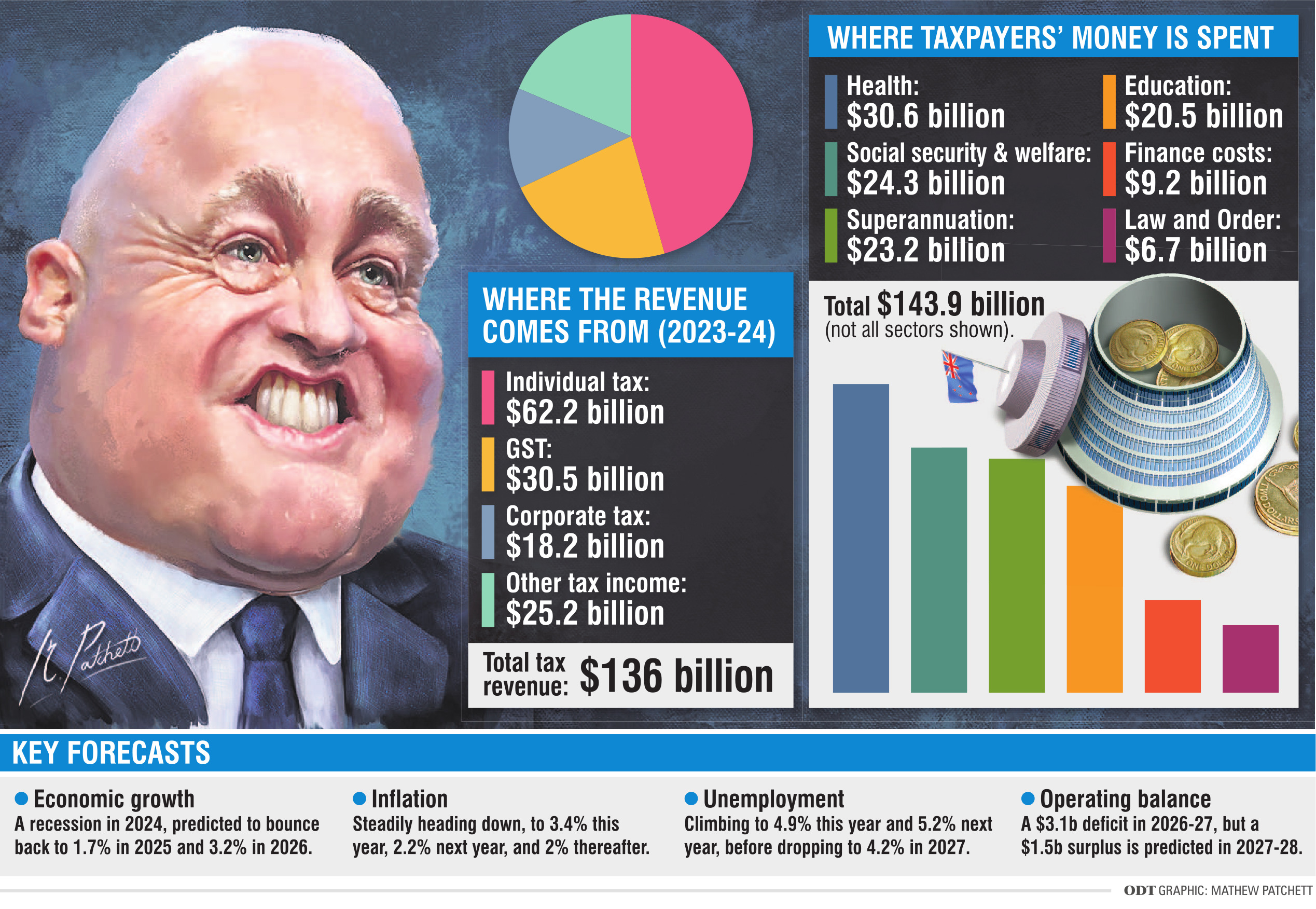

A sure sign of belt-tightening is that business income tax payments have been significantly lower than previously forecast.

Inflation is falling, but slowly — it remains outside the 1%-2% target band and all households, businesses and finance ministers want prices to fall faster.

But whether it will or not will very much depend on what New Zealanders do once they receive their long-promised tax cuts.

They were not quite so small to be in the realms of the famed ‘‘chewing gum’’ Budget but they were also not so big that people will suddenly be feeling flush.

That was probably the appropriate balance to strike, as too big a tax cut and not only the return to surplus would take longer but they would also run the real risk of driving inflation back up again.

Although averaging people’s likely increase in disposable income out on a per fortnight makes it sound better, for most single people it is an extra couple of drinks at the end of a working week and for most families it will top up the gas tank and keep the household in milk and bread until pay day.

Which does not sound like much, but Ms Willis hopes that most will accept that every little bit helps.

Budget 2024 helps a lot of people a very little, but it is no lolly scramble.