According to CoreLogic NZ’s Mapping the Market interactive tool, property values have fallen across a growing number of New Zealand suburbs over the past three months — highlighting an emerging dip in market momentum.

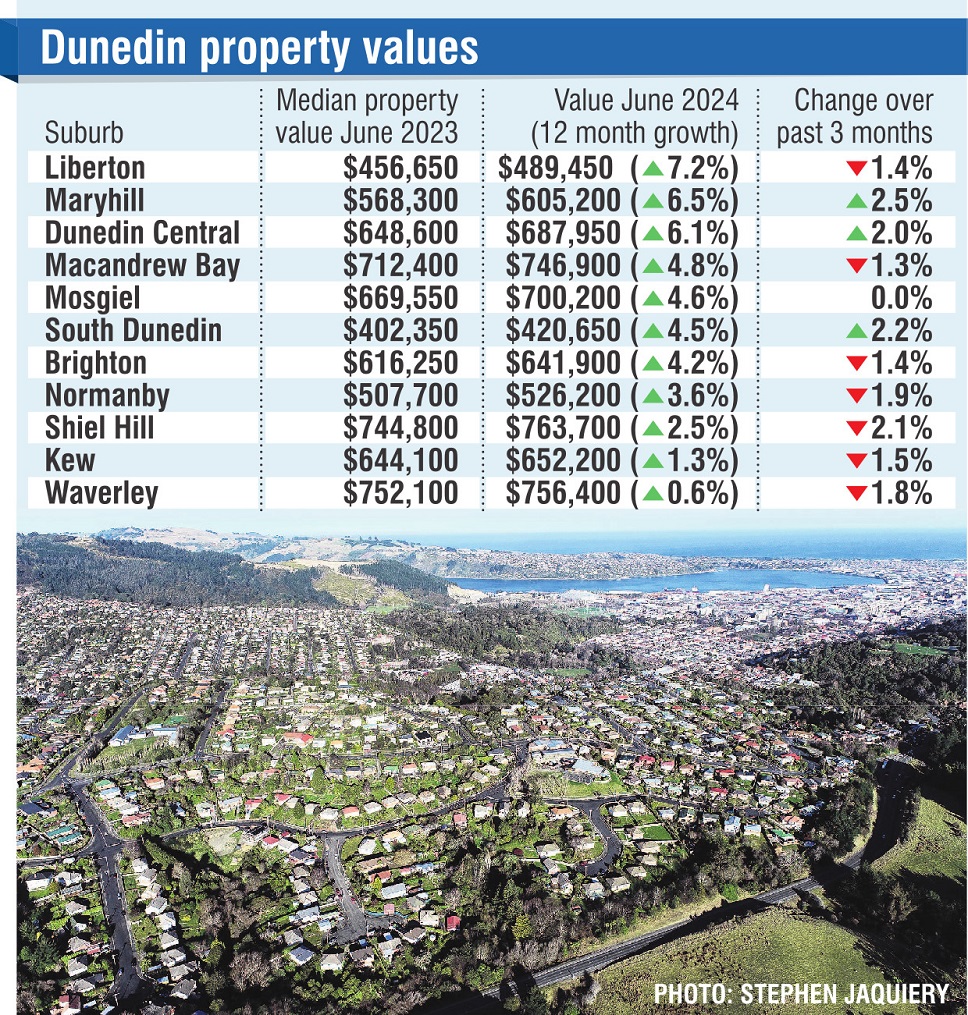

Of 63 suburbs analysed in Dunedin, all had median property values rise over the past year, with 12 of these rising by at least 5%.

Liberton, Roslyn and Maori Hill in particular have risen faster than normal, all recording value increases of between 6% and 7%.

But Dunedin appears to have cooled down in the past few months, with 13 suburbs down by at least 1% since March.

Maori Hill is the only suburb with a median value at or above $1 million, although Vauxhall sits at $970,100.

The most affordable suburb is South Dunedin at a median value of $420,650.

"I wouldn’t be panicking," he said. "It’s too early to say we’re in a fresh downturn but I think there’s enough to say that when you tease these out across Dunedin in general there’s a bit of a loss in momentum."

There was always going to be a natural variability at a suburb-to-suburb level, but the figures showed a general trend that things had slowed down and was "definitely one to take note of".

Bayleys Dunedin managing director Chris Maclean said a three-month snapshot could be handy from time to time, but was not long enough to gauge any real trend.

Seasonal changes and weather events could slow-down sales on the flat for a while, and a coincidental run of high sales could affect the median price of a suburb.

"I don’t think it’s cause for panic at all. There can be any number of things that can affect a suburb."

Dunedin was "quite a small, nimble and dynamic market" that could literally change from month to month, and a couple months of some really good sales could move the median a little bit.

Kew and Macandrew Bay were historically quite sought after and tightly held locations, and the number of sales in those suburbs would not be massive compared to others.

"If I was a property owner in those places I wouldn’t be too bothered about that; if that’s a continuing trend over six months to a year then probably you would start to look at why — but not a three-month snapshot."

LJ Hooker Dunedin managing director Jason Hynes said homeowners should read "very little" into these changes.

"You could look at the same set of data in another three months and it could flip around again."

Some of the suburbs whose median property value had dipped down at least 1% had been "very popular" and would continue to be while also experiencing monthly to quarterly aberrations.

The median property value was a fairly volatile measure that emphasised "fairly nominal" changes in the market, and this year so far had seen a stabilisation of prices.

"From 2020 through to the back end of 2023 we’ve had four years of some pretty significant movement with prices in both directions.

"This is really the first time in that past four and a-bit years where we’ve actually seen the market chugging along with no huge changes in either direction."

This period of stabilisation provided homeowners with a bit of certainty.