It comes as the Green Party moves to reopen one of the most contentious topics of the 2020 election: whether New Zealand needs to begin taxing wealth. With Labour having almost no choice but to govern with the Greens after the election, a Green Party wealth tax will likely be one of the defining topics of the election.

The data is striking: of the 201,100 trusts that filed returns for the 2021-22 income year, 149,500 disclosed an astonishing $469 billion in assets - $3.1 million on average.

Those trusts also have $160b in liabilities, leaving a net $309b in equity - an average of $2m per trust.

That’s almost as much as New Zealand’s entire GDP, which is about $390b this year, and compares favourably with the assets owned by the Government, which were worth $519.2b this year.

The data was obtained by the Green Party using Written Parliamentary Questions. It paints a picture of the vast wealth held in relatively secretive trusts.

On Sunday morning, the Green party will march into Grey Lynn, the heart of New Zealand’s capital-gains economy, to unveil its wealth and income policy. It includes a massive overhaul of the way the Government handles income support, using tools like working for families to lift minimum incomes. It will lift the minimum income that everyone from individuals to families has to live on.

The expensive change will be paid for by taxing the assets held by New Zealand’s wealthiest few, better known as a wealth tax.

The Green Party’s revenue spokeswoman Chlöe Swarbrick said, “wealth in Aotearoa is concentrated in the back pockets of a wealthy few. It’s time we get on and fix this”.

The wealth tax the Greens took to the last election taxed net wealth over $1 million. That policy only taxed net wealth, meaning if a person owned a $1.2m home but had a $700,000 mortgage, they would pay nothing unless they owned other assets that nudged them over the $1m threshold. The policy was individualised too, so a couple would have to have $2m in assets in order to be hit by the tax. The new policy will include a few substantial tweaks.

That tax plan was put to the sword by former Prime Minister Jacinda Ardern, who won a historic MMP majority, giving her the ability to pick and choose the Green policies she wanted.

Prime Minister Chris Hipkins will have no such luck. Hipkins will almost certainly need the help of the Greens and Te Pāti Māori to form a government after the election. Both parties have backed a wealth tax in the past.

Swarbrick said the trust data “reveals the enormous level of wealth hidden in trusts”.

She is concerned people are stashing their money in trusts for tax purposes, taking advantage of the fact the trust tax was 33 per cent - lower than the 39 per cent top income tax rate.

“Trusts and their contents should not just be the focus of Parliament when there are political points to be scored, such as this week, but as requiring transparency in a fair tax system and economy,” Swarbrick said.

She took a swing at the National’s Andrew Bayly who told Parliament during a debate on trusts in 2020 “there is such a thing as legitimate tax avoidance”.

“Lower income New Zealanders don’t have the same resources to move any potential assets around in the way Andrew Bayley describes, with ‘such a thing as legitimate tax avoidance’. That this happens at all demonstrates how the rules of our economy allow inequality to compound. That’s why the Greens continue to work for equitable tax settings, to pay for the things that all of us use and underpin a healthy society and functional country,” Swarbrick said.

She said the problem was not just about the level of wealth, but the fact it was relatively lightly taxed.

Research published by the IRD earlier this year found wealthy New Zealanders paid a median effective tax rate of 9.4 per cent, about half the rate of tax paid by a “middle wealth” Kiwi, which is about 20.2 per cent.

“The High Wealth Individual report by IRD found that the wealthiest in this country pay less than half the effective tax rate of the average New Zealander, frequently by using structures such as trusts and companies,” Swarbrick said.

In 2015, this group owned an average of $30m each in trust - by 2021 that had nearly doubled to $55m.

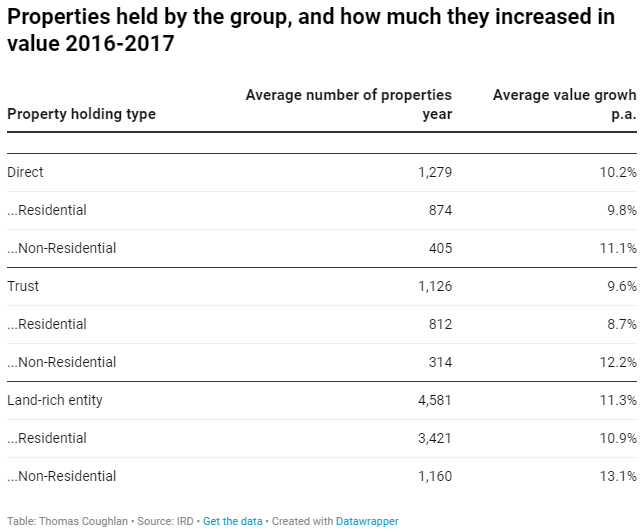

The 311 individuals from the group owned 1126 properties in trusts, which grew in value by 9.6 per cent a year.

The Government has recently moved in on trusts, hiking the trust tax rate from 33 per cent to 39 per cent in the Budget.

Revenue Minister David Parker said the change was made because the IRD was seeing enormous growth in the amount of income funnelled through trusts, probably to avoid the top tax rate of 39 per cent on income over $180,000.

“New information from Inland Revenue has shown an almost 50 per cent spike in income subject to the trustee rate, from $11.4 billion in the 2020 tax year to $17.1 billion in the 2021 tax year,” Parker said.

He said the top 5 per cent of trusts with taxable income in 2021 accounted for 78 per cent of all trustee income - $13.3b out of $17.1b.