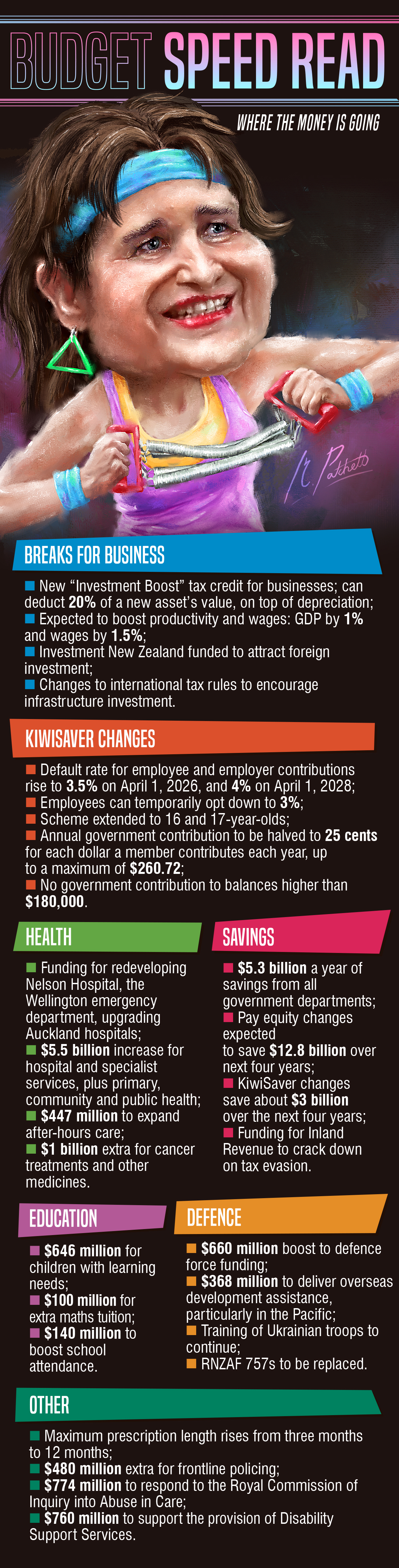

In giving them a generous tax incentive to splash out on new machinery, the finance minister is banking on business muscling up, gunning for export growth and lifting the heavy weights as the government returns to surplus on the back of their efforts.

But things are never that easy at the start of a get-fit regime: Ms Willis is spending roughly about what Grant Robertson, the former Labour finance minister whose spendthrift ways she likes to disparage, predicted he would have had he still been in charge of the books this year.

To keep its spending within acceptable bounds the government has taken some drastic moves, the biggest tummy tuck of all being the pay equity changes Act New Zealand leader David Seymour said had "saved the Budget".

Given the multi-billions saved over a four-year span he may well be right, although the crunches, stretches, push-ups and sheer political pain the government has put itself through in engineering this change have yet to show demonstrable gain.

In fact, it may be pain deferred. Women, already enduring a pay gap and with lower retirement savings than men, also stand to suffer from KiwiSaver changes announced yesterday. In addition, women have greater life expectancy and depend on national superannuation as their main source of income — and this Budget does little to address that.

The extensive KiwiSaver changes may be the most interesting thing in this Budget.

Few can argue New Zealanders do not need to do more to save for a comfortable retirement, and in gradually elevating the default rate for employee and employer contributions (to 3.5% and then to 4%) the government has followed almost exactly recommendations made to it last year by the Retirement Commissioner.

The boost offsets an accompanying slashing of government contributions to KiwiSaver balances: Kiwis are being told to fend for themselves, especially those with balances of $180,000 or more, who will no longer receive any taxpayer top-ups.

Ms Willis recognises not everyone will relish being made to save an extra 1% of their wages — employees can opt to temporarily stick at 3% should they so wish. But she also recognises not all employers relish their side of the bargain — her comment that over time employer contributions may, effectively, form part of the wage negotiation process comes with the potential to undermine the national long-term gain intended by the scheme for individual short-term gain.

In the long-term the increase in contributions may well prove to be a stalking horse for Ms Willis’ ultimate goal. It is no secret National wants to consider increasing the eligibility age for national superannuation, something which at present it is constrained from doing by coalition partner New Zealand First’s adamant opposition.

A greater emphasis on retirement savings could be seen as a part of that argument — you will have saved more should you want to retire earlier, or you can save more should you want by working for longer. An argument for another Budget.

The biggest area of growth in this Budget is health spending, a figure which the government will be keen to highlight as being at record levels. That money will buy a lot of machinery and structural steel, but little was revealed as to where the doctors and nurses who will getting New Zealanders back into shape again are to come from and be competitively paid.

The thing about gym memberships is that they require commitment. Flushed with expectation, big government has hit the treadmill in a bid to taper down and tone up.

But next year is election year, and Ms Willis will have to somehow keep the commitment to economic fitness at the same time as offering taxpayers rewards for their hard work.