The property research firm has delved into the capital gains experienced by property markets around the country since 2000.

Top of the list was Mackenzie district, which had a 1074% increase, from a median value of $64,723 in 2000 to $690,578.

Invercargill and Central Otago both had increases of 775%.

Waitaki was next, with 745% to a median of $490,223, and Queenstown Lakes 699% to $1.63m.

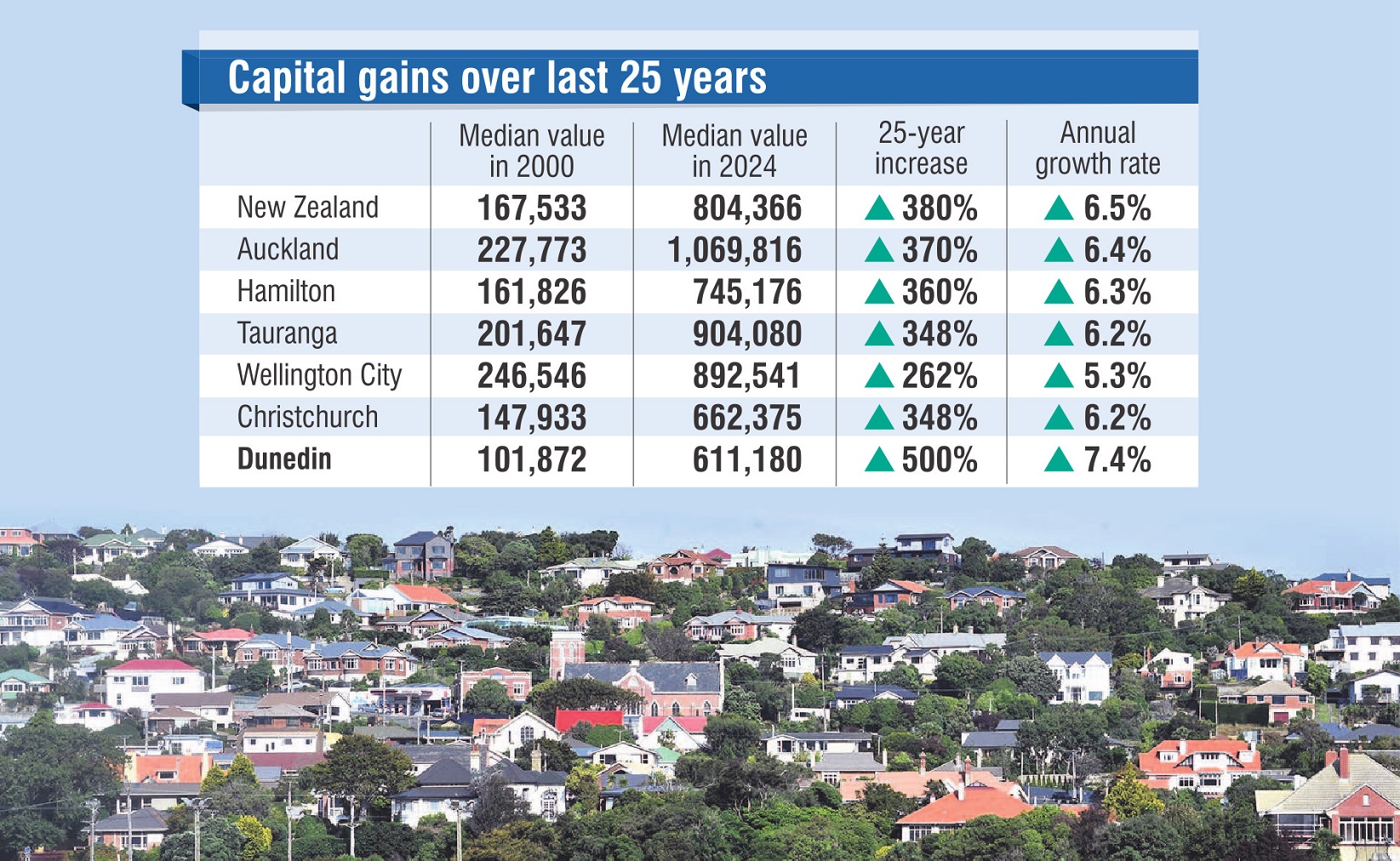

Of the main centres, Dunedin had the most growth, up 500% from a median of $101,872 in 2000 to $611,180.

Auckland values were up 370%, Wellington’s 262% and Christchurch 348%.

For the country as a whole, the median value lifted 380%.

CoreLogic head of research Nick Goodall said there were significant differences across the country.

"A 500% increase in Dunedin, compared to 262% in Wellington, does translate to quite different compound annual growth rates of 7.4% and 5.3% respectively."

He said one factor driving that increase was the lower starting price.

"It was cheaper to start off with so has often been more affordable for potential buyers.

"This has translated to a greater yield for investors, especially with relatively high rental prices, thanks in part due to the university and student population.

"Equally for homeowners, it’s more accessible and the mortgage would be more affordable.

"When measured by mortgage serviceability, for most of the last 25 years, Dunedin has been the most affordable main centre, though Christchurch did overtake it about 2017 as the rebuild led to a noticeable lift in supply, which contained house price growth.

"More recently, Wellington is now the most affordable, as house price declines — and still high incomes — have improved affordability in Wellington when compared to the other main centres."

He said the compound annual growth rate across the country was 6.5% a year.

In comparison, the NZX50 had annualised growth of 8.42% over the same period, or 655% in total.

Mr Goodall said it was likely that future growth would be closer to 3% to 4% a year.

The fundamental fall in interest rates from about 20% to 5% over multiple decades had allowed greater borrowing. — RNZ

By Susan Edmunds