It is also doubling the capital gains tax-esque bright-line test from five to 10 years - meaning any gains on a residential property that is not a family home will be taxed if the property is sold within 10 years of purchase.

And first home buyers have also been given a lifeline – the First Home Grant income caps have been lifted from $85,000 to $95,000 for single buyers, and from $130,000 to $150,000 for two or more buyers.

The changes to the house price and income caps will take effect on April 1 this year.

Prime Minister Jacinda Ardern, along with Housing Minister Megan Woods, Finance Minister Grant Robertson and Revenue Minister David Parker, made the highly-anticipated announcement this morning to cool New Zealand's overheated housing market.

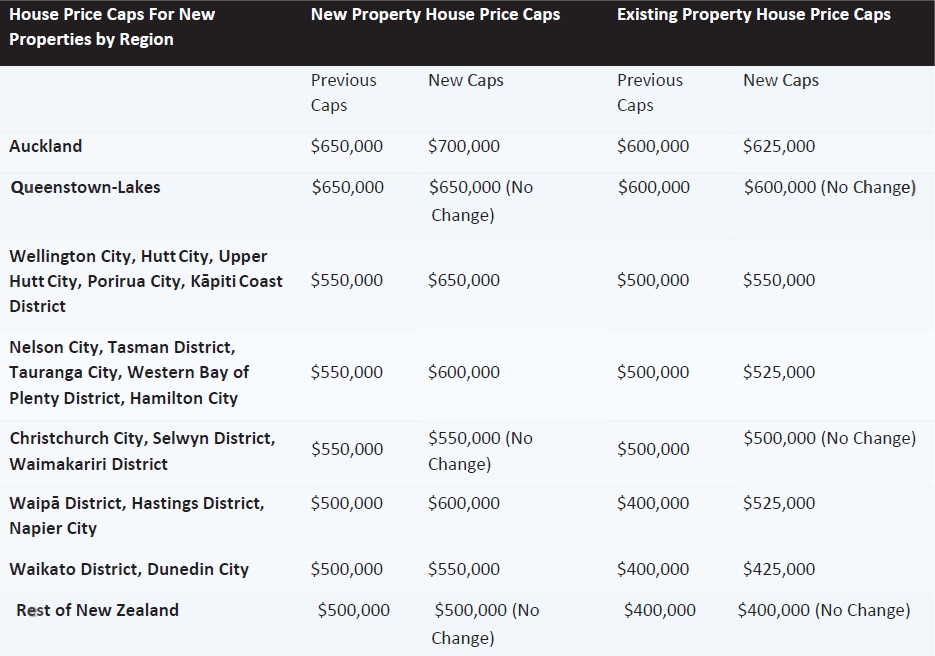

The cap on the value of the house those eligible for this grant are able to buy has also been lifted by up to $100,000 in some parts of the country.

Ardern said this housing package would increase the supply of houses and remove incentives for speculators.

"This is a package of both urgent and long-term measures that will increase housing supply, relieve pressure on the market and make it easier for first-home buyers," she said.

New Zealand's housing crisis is "long standing" and today's new measures will help to start fixing this issue, she said.

"The need for further action is clear - the last thing [we need] right now is a property bubble."

However, she said without intervention, that is where New Zealand is heading and the rate of house price growth throughout the country has been "unsustainable".

"The housing crisis is a problem decades in the making that will take time to turn around, but these measures will make a difference."

Today's announcement would help to dampen property speculation and make residential property "less lucrative" for speculators.

Ardern said it was her view that today's announcement "will make a difference" and the Government was helping to "bring down the heat" in the market.

But she said the housing crisis was "complex" - but the Government is trying to "tilt" the market to first home buyers.

The housing acceleration fund announcement will also help with supply - by helping to establish basic infrastructure, such as building pipes on vacant land.

The is the largest spend of this kind since the 1970s, Ardern said.

• $3.8b for accelerating housing supply

• First Home Grant caps lifted, as well as higher house price caps

• Bright-line test doubled from 5 to 10 years

• Interest deductibility loopholes scrapped

• Govt to offer Kāinga Ora $2b loan to scare up land acquisition

• The Apprenticeship Boost scheme extended

HOME GRANT CAPS LIFTED

The lifting of the First Home Grant caps will help more people onto the property ladder, Finance Minister Grant Robertson said.

"Housing bubbles are unstable".

The grant means those eligible can get $5,000 to buy an existing property, or up to $10,000 for a new property.

By increasing the income caps from $130,000 to $150,000 for multiple buyers and from $85,000 to $95,000 for individual buyers, approximately 9300 additional couples and 3700 additional singles who are currently renting will now newly qualify for the First Home Loan and Grant.

BRIGHTLINE EXTENSION TO CURB 'RAMPANT SPECULATION'

Grant Robertson said the bright-line test extension would help curb "rampant speculation" in the housing market.

The bright-line test is similar to a capital gains tax (CGT) on housing. It means people have to pay tax on any gains on the property if it's sold within 10 years.

There are, however, a number of exceptions - such as an exemption for a family home.

The Government announced it intended to extend the bright-line period to 10 years for residential property except for newly built houses, which will stay at five years.

The Government will pass the new bright-line test rules later today under urgency.

Prime Minister Jacinda Ardern said extending the bright-line test was not breaking her no capital gains tax promise. She said the Government was "silent" on the bright-line test before today, but the problem has become "significant".

Robertson said he was "too definitive" when he ruled out changes to the bright-line test.

But Ardern said at the time, they were not seeing the "rampant" increases.

Robertson ruled out the changes in September last year and Ardern said making the change now was not a broken promise.

Robertson said that officials had advised that house prices would fall as a result of Covid-19; but he said the opposite happened. He said the Government would monitor the impact of these changes on the rental market.

$3.8B TO SPEED UP INFRASTRUCTURE, LAND AVAILABILITY

Housing Minister Megan Woods said the new money for the housing acceleration fund - some $3.8 billion - will help greenlight tens of thousands of house builds in the short to medium term.

"This fund will jump-start housing developments by funding the necessary services, like roads and pipes to homes, which are currently holding up development."

Woods said it has become clear there is a "clear market failure" in New Zealand's "broken" housing market with the inaccessibility of infrastructure on vacant land.

She said that a lack of housing infrastructure has been a stumbling block for years and the package the Government is releasing today is "unique" by bringing together land and infrastructure.

"This package will accelerate the building of new houses, in the right place."

Ardern said she is expecting "tens of thousands" of new homes to be built because of this package.

She said the number one issue that has been raised by developers and councils is the fact there is not enough housing infrastructure in place.

Woods said the money she is dishing out will start to be spent in the second half of this year.

The Government will also allow Kāinga Ora, the Crown housing agency, to borrow a further $2 billion for it to buy land for housing.

DEDUCTABILITY LOOPHOLE CLOSED

The Government will get rid of the interest deductibility loophole – a rule which allows property owners to claim interest on loans used for residential properties as an expense against their income from those properties.

Revenue Minister David Parker said this rule favours debt-driven residential property investment over more fully taxed and more productive investments.

"To reduce investor demand for these investments, the Government will remove the advantage investors have over first home buyers."

And in a bid to get more houses built, the Government is bolstering its apprenticeship scheme, the Apprenticeship Boost initiative

The scheme is being extended by four months to further support trades and trades training.

It means employers who have apprentices starting over those extra four months can get some Apprenticeship Boost support as well, which could see more than 5000 new apprentices able to benefit.

Andrew King, NZ Property Investors Federation president was taken aback by the Government decision to eliminate interest rate tax deductions, which investors can currently claim on properties.

"What, so every other business in New Zealand can still claim tax deductions, but not landlords?" King asked. "You're joking! This is just bizarre, it's crazy."

The sums involved could be tens of millions of dollars, King said, and that would now be lost to landlords, already struggling under Residential Tenancies Act changes from last month which swung the power in tenants' favour.

The Government will now stop landlords claiming interest on loans for rental properties as an expense against their income from those properties and other forms of income such as wage and salary earnings.

King said: "We all know one of the major downsides for investors in property is that the rent doesn't cover the costs of running many places. in New Zealand, it's cheaper to rent than to buy a house.

"This change will make it almost impossible for people to provide new rental accommodation. This means the only people able to buy rental properties in the future will be those with almost all the cash to pay for the property."

Comments

So a problem created by debt is to be solved by throwing the country in more debt?

Each political party may as well fess up. They are just bank branch managers. Government and capitalism has become a factory of debt.

The growth at any cost mantra has to end. It’s a ponzi

Gotta laugh at Andrew Kings reaction. Like he didn't expect this. Of course landlords are being targeted, they are the group of investors/speculators that have been a large part of the problem when it comes to the increase in market values of houses. Does he really expect any sympathy from outside his own group?

Cry me a river.

Existing price caps $425,000 for Dunedin!

Has anyone tried to buy in the City for under $450,000

I wouldn't call it a broken promise regarding the Brightline test, I would call it a lie!! do that in court, its called perjury.

Of course you would, but what you call things is not imprimatur. Any other criminal offence you can drum up?

A lie is a lie, no matter whos mouth it comes out of!!! none are so blind as those who cannot see

Of course the govt never does anything wrong, always looks after it's citizens in your world eh.

So by the next election we can expect another 12 or so houses built to solve the problem!

This might cool the market for the first home buyers, but will be a nightmare for the renters. Expect a precipitous jump in rents. Also, in order for people to be able to buy anything in Dunedin for $450k, the median price has to drop by 20%. Even the govt does not want that.

Woods said it has become clear there is a "clear market failure"""

There is NO free market in NZ. Everything is regulated from the supply of land and infrastructure, to finance, building codes and certification of materials.

Will investors add to the homeowner supply or will they just hold on and pay the extra tax? No doubt some will and some won't.

Will new homeowners stop buying in the hope prices will fall?

Will the cost of new homes increase, as the demand to build increases pressure on material supplies?

Will the rising cost of building which includes 15% GST on materials and labour, consent costs, geotech reports, engineering, planning and permitting costs, increase the value of existing housing which were not built to the same standard?

Will the current low interest rates hold and when they start to move up again how fast will that be?

How much will rental rates rise to pay for the extra tax?

Will it be worth building new rental accommodation as an investment?

Will the cost of building a 3 BR house remain the same as building a 2BRer?

Remember, NO good deed goes unpunished, as the government continues to play with the market!!!

Let's hope it ends well.

Raising the cap on house prices under the kiwisaver grant will only put more upward pressure on price. Everything else sounds like a bandaid and will only benefit the very select few the govt decides to socially house.

Once again the middle class gets screwed, $400k -> $425k is a joke and shows how out of touch this govt is, dunedins house prices are higher than christchurch's and yet she wont even raise us to their limit?