Across Oceana's two New Zealand mines, at Macraes and Waihi, and at Didipio in the Philippines and Haile in South Carolina, the cost of producing an ounce of gold rose from $US814 ($NZ1220) in the previous quarter to $US1026 ($NZ1538).

However, at Haile, the cost was more than double the average, at $US1785 per oz, while the average gold price achieved from that mine was $US1301 per ounce.

A second underground mine at Macraes, a possibility announced last year, is still in the wings and at Waihi it continues to work up plans to start a new Martha underground project, which already has resource consent.

Revenue for the first quarter to March was down 8.7% from $US196.7 million a year ago to $US179.5 million, earnings before income tax fell 55.4% from $US45.8 million to $US20.4 million and after-tax profit plunged 72.1%, from $US44.5 million to $US12.4 million.

Combined cash and equity investments stood at $US132.2 million.

Oceana chief executive Mick Wilkes said while there were ''solid'' operating performances from Macraes, Didipio and Waihi, there were ''continued mining challenges'' at Haile.

''At Haile, the first two months of the year were challenging for us, with low production, productivity and high costs,'' Mr Wilkes said in a market update.

He attributed the higher costs, particularly at Haile, to higher total sustaining capital, combined with lower average feed grades and gold sales volumes.

For much of the quarter, Haile remained ''saturated'', the site having received 1270mm of rain since September last year, including about 254mm over January and February. The historical monthly average is 96.5mm.

''Despite this unusually wet weather and severe storms, the operation did not sustain any environmental breaches,'' he said.

Craigs Investment Partners broker Peter McIntyre said the first-quarter result was ''messy'', mainly because of Haile, which could continue into the next quarter.

While noting gold grades at Macraes were expected to be lower, that issue was not unfamiliar to Oceana.

He described Oceana's balance sheet as ''relatively good'', given debt was below $US100 million, its cash in hand balance stood at $US87 million and it still had $US50 million undrawn from a credit facility.

Mr Wilkes said mining unit costs at Haile increased due to the removal of soft clay material and infrastructure improvements, including installing 11 additional water depressurisation wells.

''To mitigate against future high seasonal rainfall periods, an additional 15 water depressurisation wells are planned along with the continued removal of softer clay material ... for the remainder of the year,'' Mr Wilkes said.

He predicted Haile production would increase in the second quarter and second half of 2019 on higher gold grades and better mine productivity, and costs were expected to decrease throughout the year.

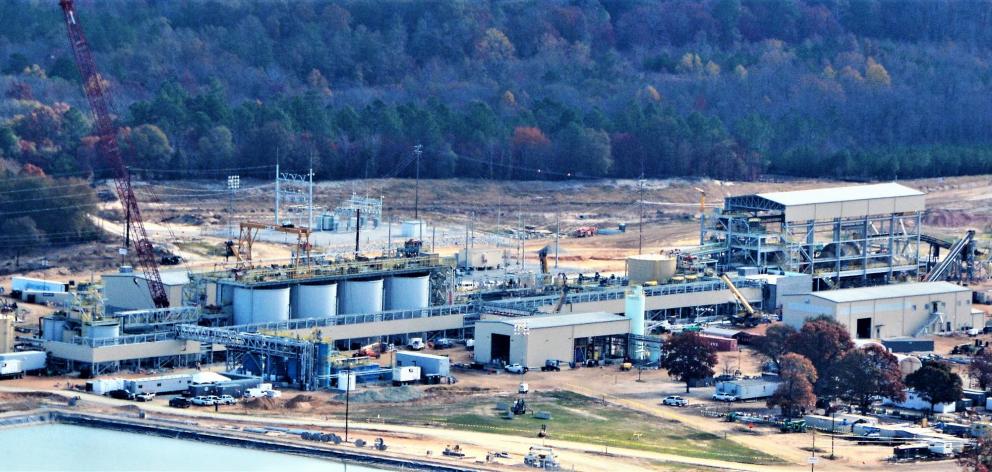

Plans are under way to go underground at Haile, with permits expected by the end of the year or by early 2020.

Mr Wilkes reiterated that through exploration and mine planning, Oceana was seeking to extend the life of the Macraes mine.

''One of these opportunities is at Golden Point, where the company is investigating the potential for a stand-alone underground operation,'' he said.

Historically, the gold per tonne of ore from the existing Frasers underground mine has been about double that recovered from open-pit operations.

Oceana maintained guidance, forecasting 500,000 to 550,000 ounces of gold in calendar 2019, and up to 15,000 tonnes of copper.