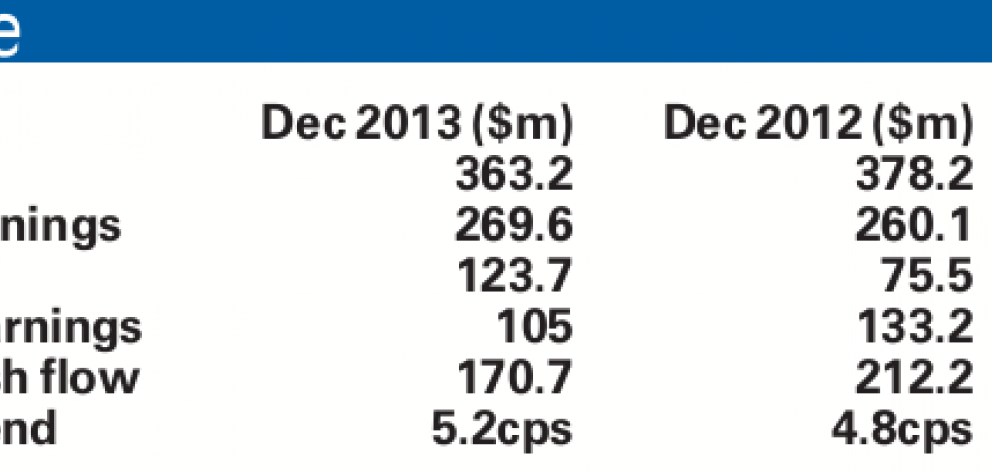

The company, which was partially privatised by the Government in May last year, reported operating earnings of $270 million, up $9.5 million, in the period, despite record-low hydro inflows.

The company declared a dividend of 5.2c per share and reaffirmed it was on track to achieve its full-year forecast of $498 million in operating earnings.

Chief executive Doug Heffernan said the achievement was challenging in light of the drought conditions that had affected the central North Island in the past 12 months.

Hydro volumes were down 34% in the first quarter which, over the full period, equated to a loss of more than $33 million in potential operating income because of inflows into Lake Taupo being the lowest since the company was formed in 1999.

That was partially offset by the additional contribution from geothermal with the completion of the new Ngatamariki station at the end of August, together with higher-than-expected cost savings, he said.

Electricity sales volumes to businesses were down more than 9% in a low-margin commercial market as Mighty River Power chose to reduce business sales to where they were a year ago.

That helped lift the average sales across the portfolio by 2% in the six-month period.

Mighty River Power announced in December a commitment not to increase residential energy prices at least until April 2015, reflecting the highly competitive retail environment.

''This means the only increase on customers' electricity bills will be where there are regulator-mandated increases from transmission, distribution and metering charges.''

Residential sales volumes were down 5% on the previous half-year, partly because of warm winter and spring temperatures resulting, on average, in lower bills for residential customers.

Craigs Investment Partners broker Chris Timms said the Mighty River Power result showed the benefits of partially listing the former state-owned energy company.

As expected, the company was open to more oversight and had become more efficient by taking costs out of its operations.

''I've always said the companies would be more efficient when they came out of being an SOE. The detractors said the partial listings would result in higher power prices with no real benefit to customers. Power prices have continued to fall.''

The contrast between Mighty River Power having battled drought conditions and Meridian having had higher-than-normal hydro flows showed how seasonal contrasts were dealt with by the energy companies, he said.

Next year, Meridian might be facing dry conditions, while the North Island could be wet.

''While storage had built up to 100% of average by the end of December, the company indicated it is currently at just over 60% of average. Wholesale prices are well above averages at the moment, but Mighty River appears to be restricted from materially benefiting. However, we expect it did take advantage of higher dam levels and high prices up to mid-February and has made a good start to achieving its numbers,'' he said.

Chairwoman Joan Withers said the company had lowered its estimate for capital expenditure for the full year from previous guidance of $125 million-$175 million to $95 million-$120 million because of lower investment domestically as it implemented cost containment plans and in international geothermal, where a patient approach to growth had reduced commitments.