CoreLogic head of research Nick Goodall said its latest house price index figures, released on Wednesday, showed a downturn in the country’s housing market as it lost momentum over the final months of 2022.

Additional interest rate rises this year were likely to lead to "ongoing weakness" in the property market, Mr Goodall said.

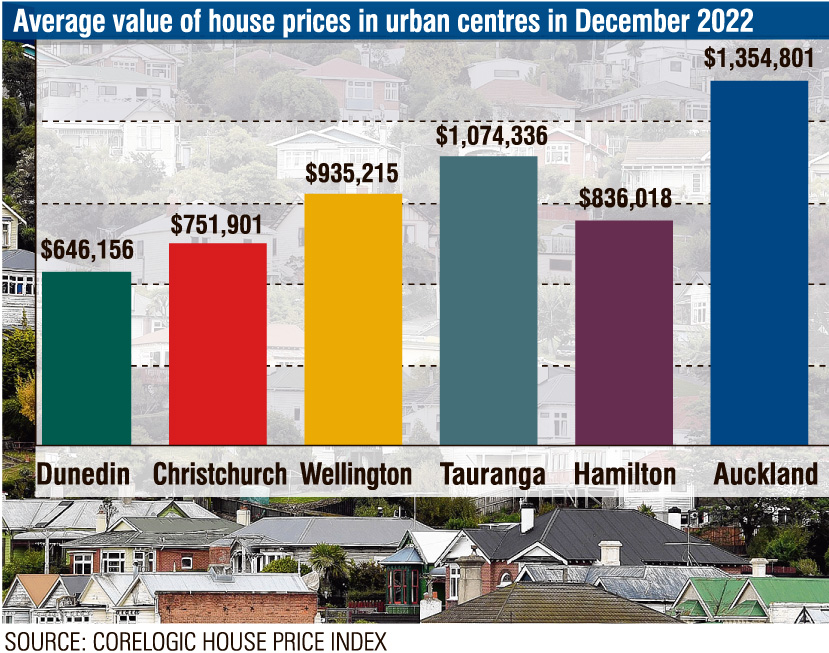

In Dunedin, house prices fell 0.2% in December, the fourth month in a row where values had moved little.

The average Dunedin property value is now 0.1% higher than three months ago, and 9.5% lower than the same time last year.

Nationally, prices rose by 27.6% over 2021 and fell by 5% over 2022.

Compared to the rest of the country, the market might be closer to finding a floor in Dunedin, Mr Goodall said.

LJ Hooker real estate agent Lawrence Schaumann, of Dunedin, said things were hard to judge going into 2023, especially in Dunedin.

"Obviously there’s still a bit of hurting to come with the interest rates ... there’s probably a few more rate rises to come," Mr Schaumann said.

He believed the market would probably stay fairly stagnant after the next six months ran its course.

The best case scenario for the next couple of months would be if stock levels remained relatively constant and banks remained positive about lending.

in the worst case, a flood of properties could come on to the market while banks were unwilling to lend, which had the potential to cause "a bit of havoc", Mr Goodall said.

In a nutshell, the Dunedin market was pretty solid at the moment.

"Its not as doom and gloom as other parts of the country," Mr Goodall said.

Trends in Dunedin tended to stay consistent across the city and the hospital rebuild was likely to keep the market buoyant, Mr Goodall said.

Nidd Realty owner Joe Nidd said the end of the year had been marked by prices getting a bit more competitive.

Some buyers had been finding finance easier to get than six months ago, which had stimulated activity towards the end of the year.

This month would likely see "quite a substantial injection of new property into the new market" and buyers coming back from the Christmas break re-energised and ready to make a decision.

Prices in the Dunedin area had held steady around the $600,000 mark for the last few months and he expected the trend to continue.

"We don’t expect the prices to plummet anytime soon," Mr Nidd said.

Dunedin generally had a more tempered version of the national market, so while it did not reach the heights of some other centres, it was also likely to avoid some of the troughs.