National has kept its tax cut promise in the coalition's debut Budget, laying out a relief package largely in line with the 'Back Pocket Boost' it campaigned on during the election.

The coalition government today delivered its first Budget since being elected in October last year. Prime Minister Christopher Luxon had sought to temper expectations, saying there would be no frills and no surprises.

Finance Minister Nicola Willis said the government's priorities were delivering meaningful tax reductions; identifying savings across government departments and agencies; improving public services through focused new spending; keeping tight control of government spending; and developing a long-term, sustainable pipeline of infrastructure investments. Other priority areas also include health, education and law and order.

Unveiling her first Budget this afternoon, Finance Minister Nicola Willis declared: "I have kept my pledge".

Willis described the near $15 billion tax cut package as "fully funded" over four years, pointing to $23b in savings across the public sector over the same time.

The government expected to borrow an extra $12b during that same period.

Asked why she pushed ahead with tax cuts rather than reducing debt, Willis said doing otherwise would have meant breaking their commitment to New Zealanders: "We chose not to do that".

Willis characterised her first Budget as a "clean-up job" which delivered on key coalition promises.

"This Budget wont fix all of New Zealand's economic challenges on its own and there is much more to do, but it does show what is possible with care and discipline."

TAX CUTS

The Budget documents stated 1.9 million households would benefit from the overall relief package by an average of $30 a week. Households with children would benefit by $39 a week on average.

A minimum wage worker could expect about $12.50 a week, while superannuiants would take home just $4.50 a week.

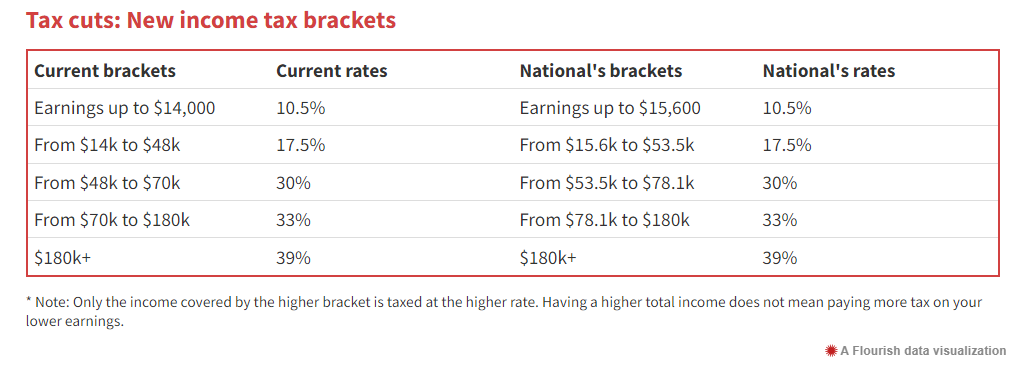

The key plank of the policy was an adjustment to income brackets, with tax rates remaining the same but the thresholds where they kicked in increasing.

The Independent Earner Tax Credit is also being expanded, with the upper limit for eligibility rising from an income of $48,000 to $70,000, with amounts reducing from $66,000+ instead of $44,000+.

National campaigned on enacting these changes at 1 July, but the start date has been pushed back four weeks after advice from Inland Revenue to allow payroll providers more time.

The in-work tax credit will also go up by up to $25 a week from 31 July. National had campaigned on that kicking in from April 1.

The relief package also includes a childcare payment for low-and-middle-income households as already announced by Willis in March.

The original 'Back Pocket Boost' policy included an increase to Working for Families, but that promise was discarded during coalition negotiations.

During those negotiations, National also agreed to consider whether ACT's idea of a flatter tax system could be incorporated "subject to no earner being worse off than under its plan.

Willis said ACTs idea of reducing the number of tax rates had a lot of merit but was not possible this year or this term: It remains, however, an idea for the future.

The overall policy is costed at $3.7b a year which Willis said was fully-funded through specified savings and revenue initiatives.

NIP AND TUCK

Willis said a line-by-line review of government spending had identified an average $5.86b a year across 240 savings and revenue initiatives.

That included a baseline savings exercise across government departments which had raised more than $1.5b a year.

Most departments met or came close to their savings target of 6.5 percent or 7.5 percent with the notable exceptions of the Defence Force, Police, and the Ministries of Foreign Affairs and Justice.

The Ministry of Housing significantly exceeded its savings goal of $109m, instead cutting its baseline by $391m.

Initiatives in line for a funding shave include the NZ Symphony Orchestra, the Human Rights Commission, the Major Events Fund, and the Climate Change Commission.

The Warmer Kiwi Homes scheme is also being scaled back with the end of subsidies for hot water heating and an outreach programme to target hard-to-reach households.

Some savings have been recouped by shifting the first-year of Fees Free to the final year of study, taxing online casino operators, and increasing immigration fees.

Savings and reprioritisations will be a business-as-usual activity for all ministers so that we can put the books back in order, Willis said.

NOT ALL PROMISES KEPT

During the campaign, National pledged to give the government's drug buying agency Pharmac an extra $70m a year over four years in ring-fenced funding to target 13 specific cancers.

"We regret that it hasn't been possible in this Budget", Willis said.

She pointed to the major investment required in Pharmac and cited difficulties with the promise, given it would result in a significant shift to Pharmac's operating model.

Regardless, Willis said the coalition remained committed to following through on its commitment in future Budgets.

"We are determined to deliver it and we will."

'DIFFICULT BUDGET'

Deputy Prime Minister Winston Peters believes New Zealand has changed gears from "reverse and backwards" to "forwards and progress" with the Budget.

The coalition leader from New Zealand First acknowledged the work of Finance Minister Willis and her associates.

Putting together a Budget in an economic crisis was a "difficult undertaking", he said today.

Putting two thirds of new spending into health, education and law and order was the government's response to the left, Peters said.

The ministers putting the Budget together faced a "tsunami of debt" - and so did the government, he said.

He spent much of his speech in the House taking aim at other parties, and faced calls from Opposition MPs to speak about the Budget while he talked about other matters.

THINGS ARE GRIM: SEYMOUR

Coalition leader David Seymour from the ACT Party said this year's Budget was not flashy - "it happens against a backdrop where things are grim".

The tax cuts did not amount to spending: "we are taking less of people's money in the first place," he said.

He believed a tax deductibility for landlords would bring down rents, which would in turn help tenants purchase their own home.

"We are cutting taxes in a responsible way by less than we are cutting spending, so we also get back to balance, we also take inflation out of the economy, we also allow the Reserve Bank to take pressure off mortgage rates, interest rates, and allows more Kiwis to have a bit more money left at the end of the fortnight."

New Zealand needed a government that was as careful with "other people's money as the people who earned it".

The coalition government planned to do more with less money, he said. "This is a Budget for the ordinary New Zealander who wants to make a difference in their own life and be the person they want to be, not the person someone else wants them to be."