There are currently more properties for sale in Christchurch at the moment than there have been in the last three years and they are taking longer to sell.

And with agents’ phones still running hot and people wanting to list properties both now and early in the New Year, those numbers could continue to rise.

But despite it being a buyers' market with plenty of choice for house hunters, agents told OneRoof prices have only dropped by about 5% in Christchurch compared to the much bigger drops being felt in other major metros.

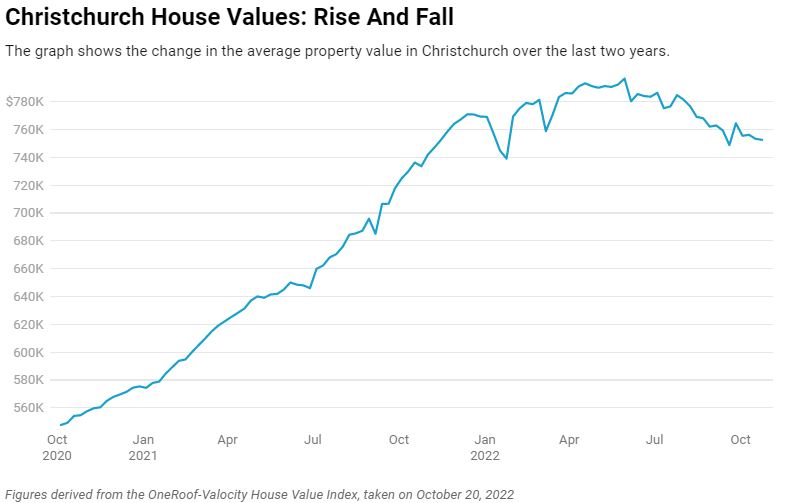

OneRoof-Valocity figures show a similar decline in Christchurch’s average property value since the market peak in May.

“What happens when you double the stock and you’ve got the same buyer pool or less buyer pool – it just becomes slower and more challenging and that’s probably what we are facing.”

The slowdown that happened in some of the other major cities, such as Auckland and Wellington, has started to trickle down to Christchurch, she said. But the drop in house prices has been nowhere as severe.

“Because our median sales price is that much lower than Auckland, we are just not seeing the big dramatic drops. And while we went up 20 to 30% and I guess they did too, theirs has come back 15% to 20% and we haven’t seen that dramatic drop.”

Dovey said while the price drop cannot be seen in the statistics yet, they are feeling it on the ground and estimated it could be around 5%.

The more expensive houses still seemed to be selling well, while the mid-range family homes priced between $700,000 and $800,000 were being a bit more impacted, she said.

“Those price points in the middle where you’ve got kids, you’ve got more expenses and it’s just the pressure in that price bracket.”

Even with Christmas just around the corner, Bayleys salesperson Adam Heazlewood said it is not stopping people from putting their houses on the market either now or making plans to at the start of 2023.

And while the Christchurch market is softening, Heazlewood said it is nowhere near as dramatic as what appears to be happening in some other parts of the country.

“It’s having the same trends of slowing and the average days on market growing, but it’s still considerably better than what I’m hearing in the likes of Auckland,” he said.

“There’s a good amount of choice. There’s still emotional buying happening, but buyers are definitely on average more calculated than they were and that’s obviously because of the current environment we are seeing with the OCR changes and the rest.”

Harcourts Grenadier managing director Andy Freeman said while fewer properties are selling, it hasn’t had a huge impact on sales prices.

“Everything has just slowed down – there's no rush anymore so people are just taking their time. But I don’t believe the values have dropped a hell of a lot – they are saying 5% and that could be correct.”

Ray White Metro sales and auction manager Richard Withy said the “crazy boom time” was a thing of the past, but there are still buyers looking as it returns to a more normal market.

“We are still getting good numbers to open homes. They are a bit patchy from area to area, property to property. I think that’s a combination of what's happened around the rest of the country in terms of the main centres and how they’ve come off that boom market.”

Areas such as Somerfield, Beckenham, St Martins, Cashmere and Mount Pleasant are performing better than others and well-marketed, well-presented and well-represented properties are still selling well, he said.

While those properties proving a bit harder to sell are two-bedroom townhouses and houses in some of the newer subdivisions, such as those in Rolleston, where there is a lot of stock on the market.

Withy said the higher levels of stock they are seeing across the board does put pressure on prices, but he doesn’t think the drops will be as steep as those in Auckland or Wellington.

“As there’s more stock, there’s more pressure on price because you’ve got more competition. So, yes, there’s more pressure than there’s ever been before on price and sellers really have to do everything perfectly from the start to get (the) result they hope for and buyers have more choice, which if the price is not right they will move onto the next one until the price is right.”

However, there is no Christmas slowdown in sight just yet with all the agencies telling OneRoof they are gearing up to call a large number of houses at auction in the next few weeks.

That said, they usually had a “bit of a burst” before it started to quieten down in the second week of December as people moved into holiday mode.

-By Nikki Preston

OneRoof.co.nz