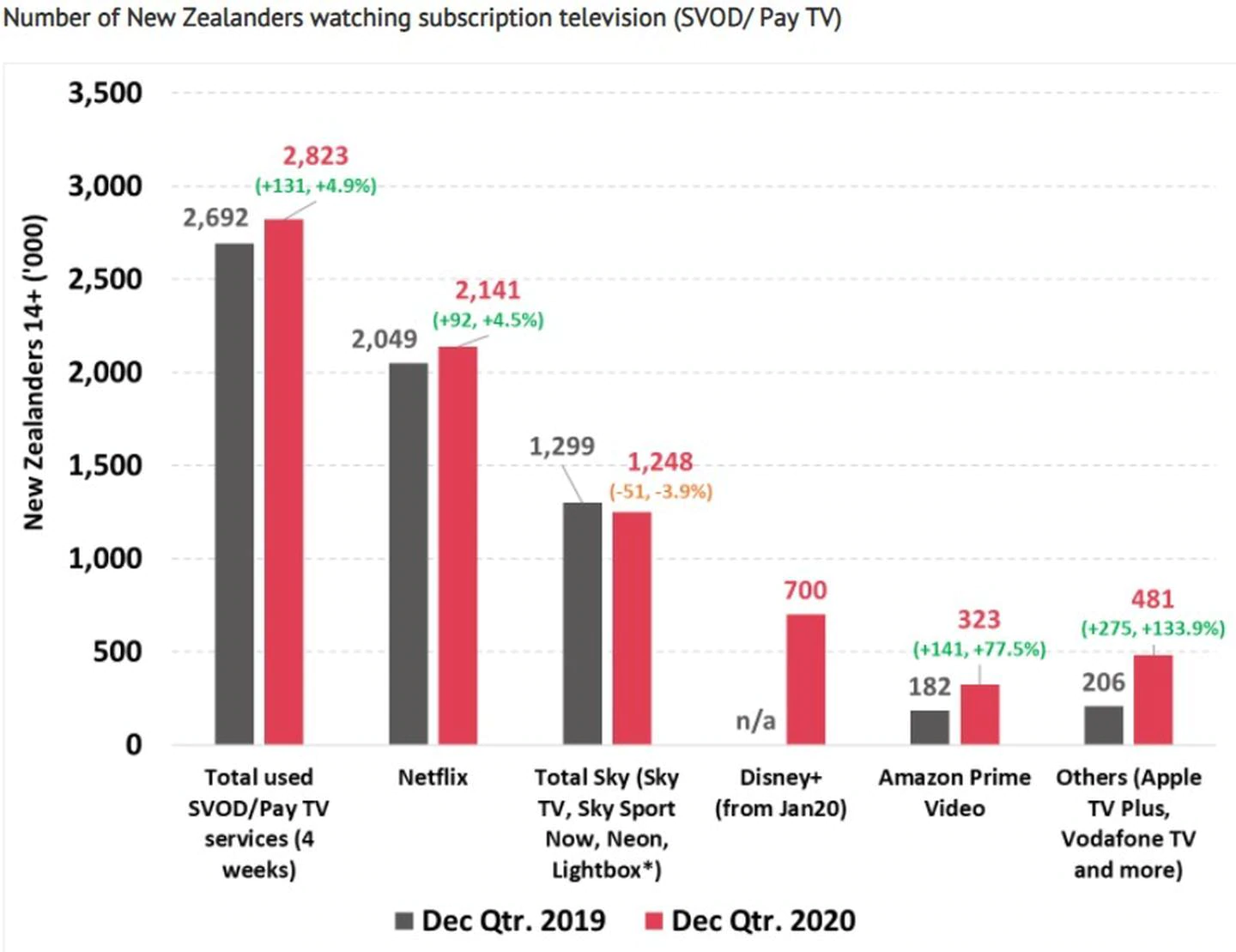

The research company surveyed just under 2000 Kiwis aged 14+, then extrapolated its results to find the number of New Zealanders watching pay-TV (defined as subscription video on-demand or subscription TV services like Sky) increased from 2.69 million to 2.82m over 2020.

The biggest winner was newcomer Disney+ which gained an audience of 700,000. Disney+ launched worldwide in November 2019.

Roy Morgan's figure gels with the Magic Kingdom's financial report for the first quarter of this year, which said the number of subscribers to the $9.99/month Disney+ jumped from the year-ago 26.5m (when the service was just two months old) to 94.9m worldwide as of January 2.

Another newcomer, Apple TV+, helped to pump up the "Other" category, along with the new-generation Vodafone TV, which offers Sky channels plus a choice of third-party apps. Apple TV+ had a relatively soft launch next to the hard-nosed approach by Disney, which pulled its content from Sky TV and other partners around the world to make its streaming service the only source for most of its content.

Disney's efforts were also helped by the hit Star Wars spin-off The Mandalorian, and its Covid-inspired decision to release its Mulan remake via Disney+, skirting theatres in most territories.

Some analysts originally saw Disney+ and Apple TV+ eroding Netflix's market lead, but a rising tide of lockdowns has ended up lifting all boats in the streaming market.

Amazon's Prime Video soft-launched here in 2016, but has only recently had its first major promotional drive via a free bundling offer for 2degrees customers. Amazon does not give figures for Prime Video. Amazon is currently shooting the biggest-budget TV or streaming series ever - its Lord of the Rings effort, currently in production in West Auckland - should give it a lift once it hits screens.

The only contender to go backwards is Sky TV, whose pay-TV and streaming services are lumped in as one total audience.

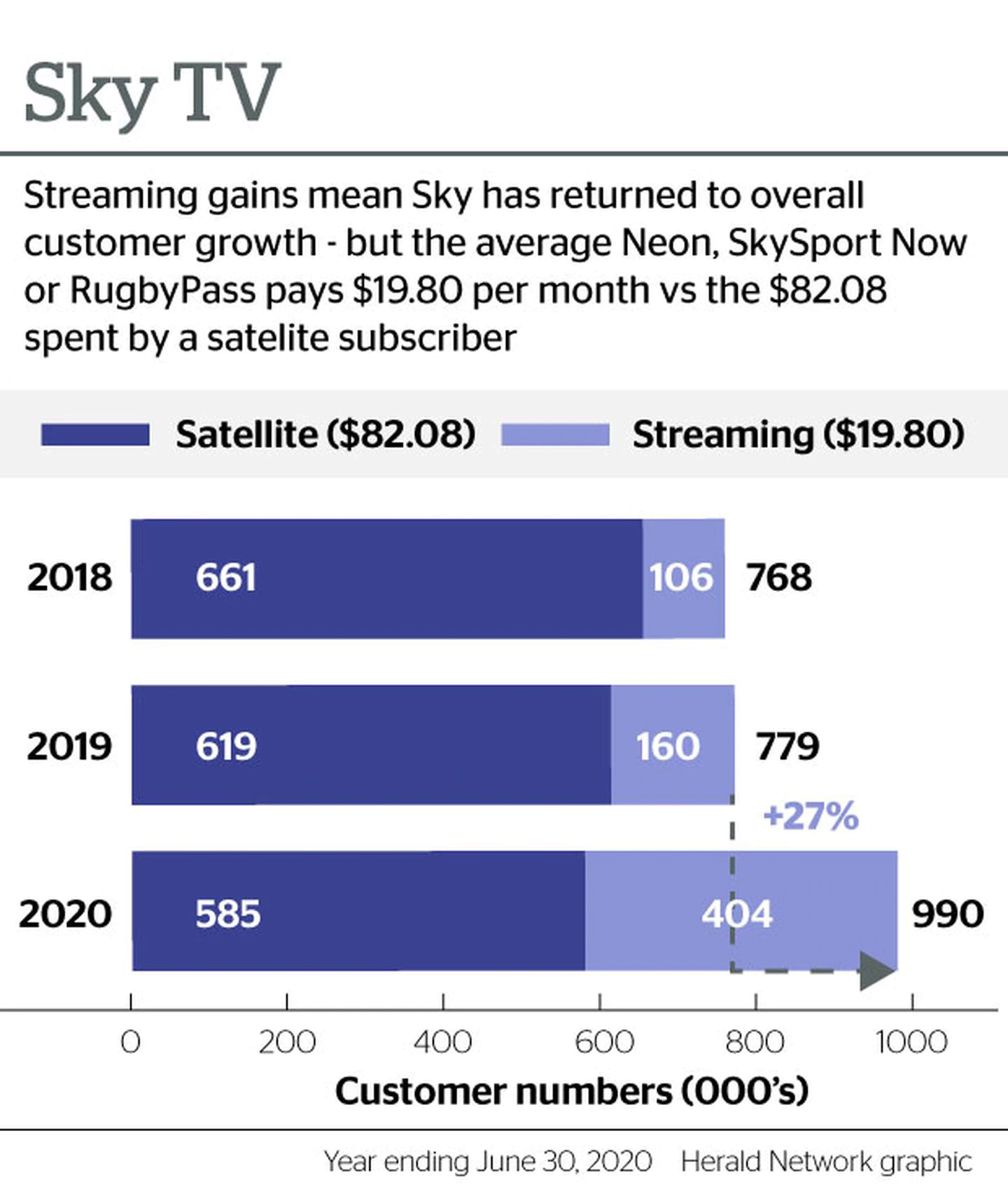

This runs contrary to Sky's NZX filing for its 2020 financial year, which showed a big jump in total paying subscribers as a boom in streaming numbers outweighed the ongoing fall in satellite customers (see chart below).